Time for a saving spree – tax free!

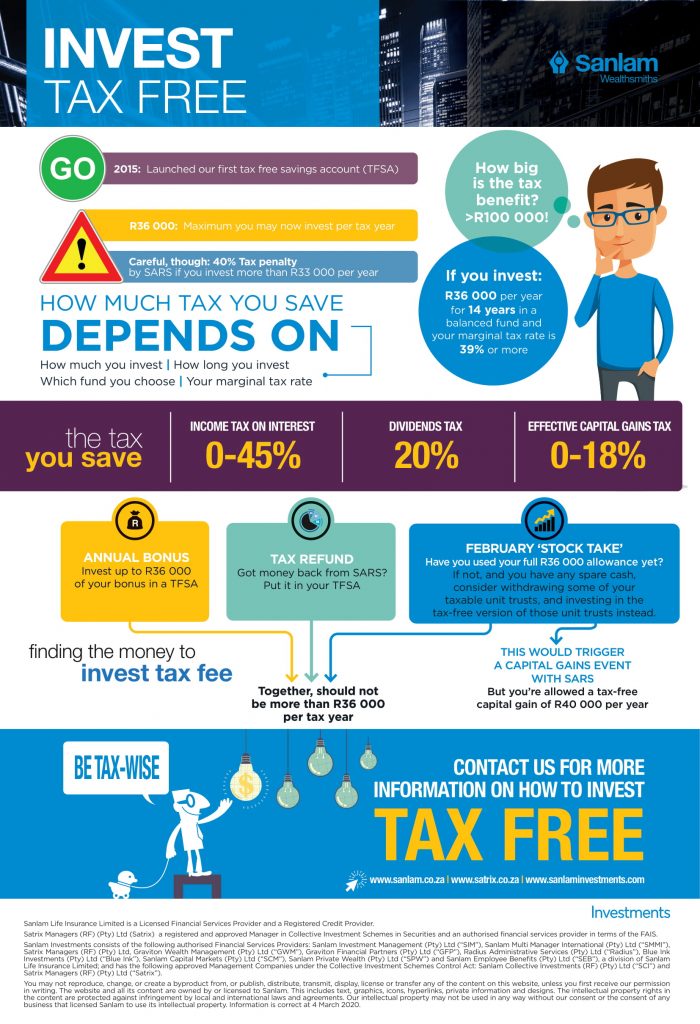

Each year investors have until the end of February to make their annual contributions to products that facilitate tax-free investing. Other than a retirement annuity (RA), investors also have the option to contribute to a tax-free savings account (TFSA) to make full use of their annual contributions allowed by SARS.

The benefits of a TFSA

All the proceeds – dividends, interest and capital gains – are tax-free. After several years of investing in a balanced or equity portfolio, the capital gain payable when ultimately withdrawing the money could be substantial. This tax benefit makes the TFSA very attractive relative to discretionary, taxable products.

The contribution limits of a TFSA

TFSA investors’ overall contributions are limited to R36 000 per tax year. Any contributions exceeding the annual cap will be taxed at 40% and therefore need to be monitored carefully to remain within the annual limit. Investors cannot roll over this year’s unused allowance to next year, so if they don’t contribute before the end of February, they’ve missed the boat for the 2019/2020 tax year. A lifetime contribution limit of R500 000 also applies.

Are the tax benefits really that significant compared to a taxable product?

The benefit may be small during the first few years, but as the value of the investment grows, it becomes significantfor long-term investors.

Which TFSA products does Sanlam Investments offer?

Sanlam Investments offers three tax-free products administered by Sanlam Collective Investments (RF) (Pty) Ltd and Satrix Managers (RF) (Pty) Ltd. They are the:

- Sanlam Collective Investments tax-free unit trusts

- Satrix tax-free unit trusts

- Satrix tax-free ETF range.

The Sanlam Collective Investments tax-free unit trust is for investors who prefer actively managed funds, run by portfolio managers who research and analyse the investment universe before picking only certain assets within an index. The minimum investment amounts vary from fund to fund, and start at R500 per month. The Satrix tax-free unit trust is for those who prefer low-cost passive investments (the portfolio manager buys all the assets in a particular index).

It is possible to invest in the Satrix and Sanlam Collective Investments offerings online but we recommend that investors first meet with a financial adviser to select the fund most suitable to their investment goals.

Don’t miss the boat!

The sooner investors open a TFSA, the sooner the power of compound returns can start working in their favour. Even better when those returns are tax free!

Comments are closed.