The Great Myth: Passive Funds Fail In Volatile Times

Since July last year, market volatility is back and it’s not expected to retreat anytime soon. As a consequence, the money is flowing towards safer havens. Traditionally, passive investments (index funds) were overlooked when stock prices started their yo-yo journey. The perception persists that passive funds are not able to take advantage of volatility in the market as well as their active counterparts. But this perception is unfounded.

- The extraction of style factors, such as the Value factor from the plain vanilla equity indices

- Strategic asset allocation – the blending of equity, bond and property indices.

Let’s test how well each of these aspects of passive investing has dealt with market volatility in the past.

1. Value investing – a passive approach

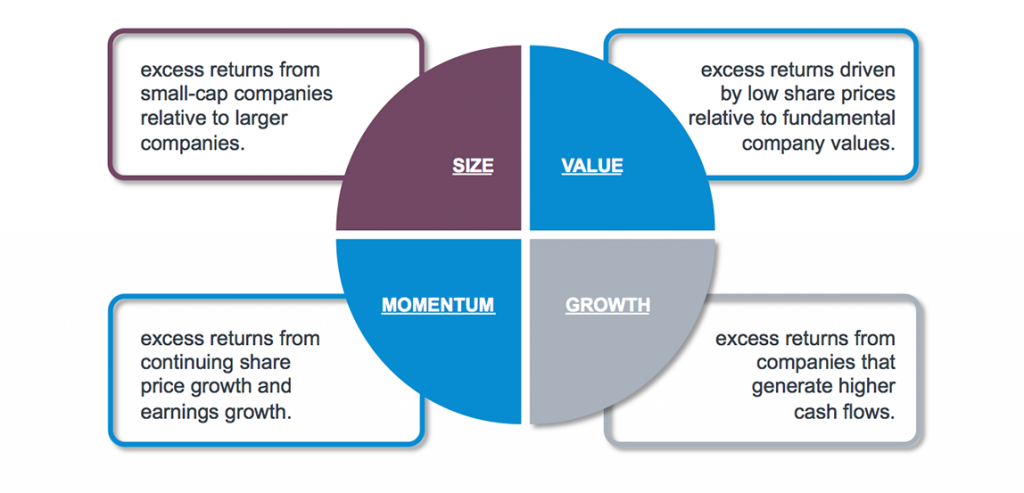

Active managers will have different philosophies and processes to generate their “alpha” relative to various market indices (e.g. the FTSE/JSE All Share Index), such as a bias towards:

- Value stocks;

- Growth stocks;

- Momentum stocks; or

- Small cap stocks.

But passively managed strategies can also isolate these factors and offer a similar “alpha” experience to that of actively managed strategies.

As we’re on the topic of volatility, the factor that normally does best in downward markets would be Value – the philosophy where excess returns are driven by low share prices relative to fundamental company values.

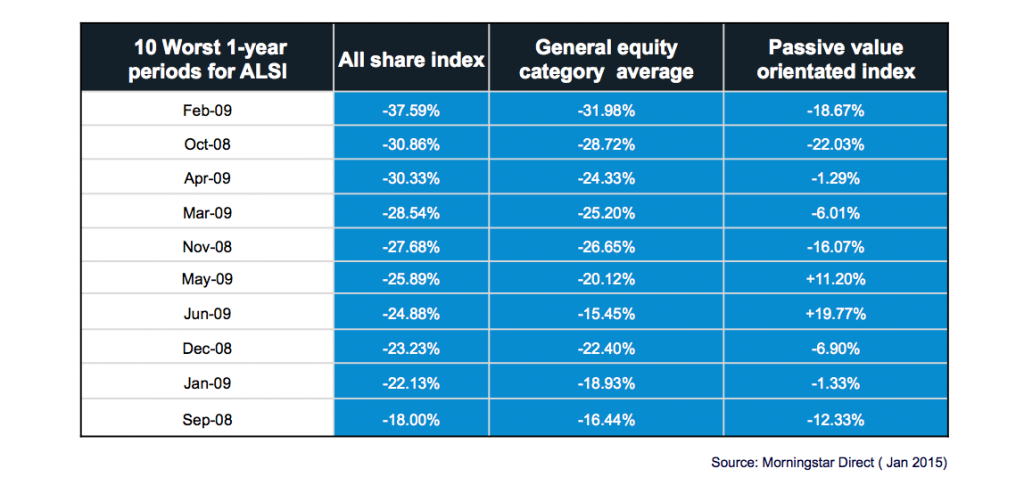

Turning theory into practice, the chart below lists the 10 worst one-year periods within the local equity market over the last 30 years. Comparing the FTSE/JSE All Share Index (ALSI) and the category average of the ASISA South African Equity General sector with a passive value-orientated index, represented by the Satrix Dividend Plus Index Fund, it’s evident that the passive strategy holds its own over all 10 periods, even producing positive returns for some periods (shown below).

2. Blending market indices to create a passively managed balanced fund

2.1 Satrix Balanced Index Fund

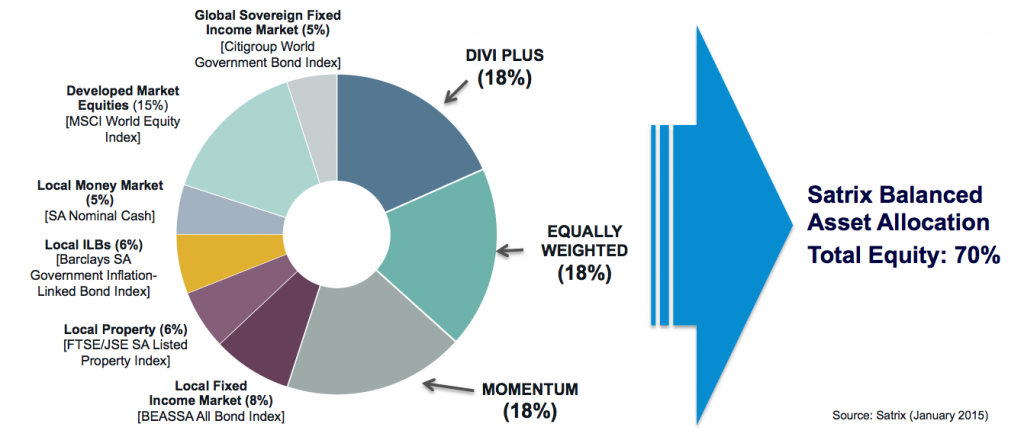

The Satrix Balanced Index Fund is a Regulation 28-compliant fund that offers diversified exposure to all the key local and international asset classes, with a smart SA equity core. The Fund invests in a range of underlying smart equity indices: FTSE/JSE Dividend Plus Index (value exposure), FTSE/JSE Equally Weighted Top 40 Index (size exposure) and Satrix Momentum Index (momentum exposure).

The fund was designed around a thoroughly researched strategic asset allocation (SAA) process, with the following weights assigned to each component:

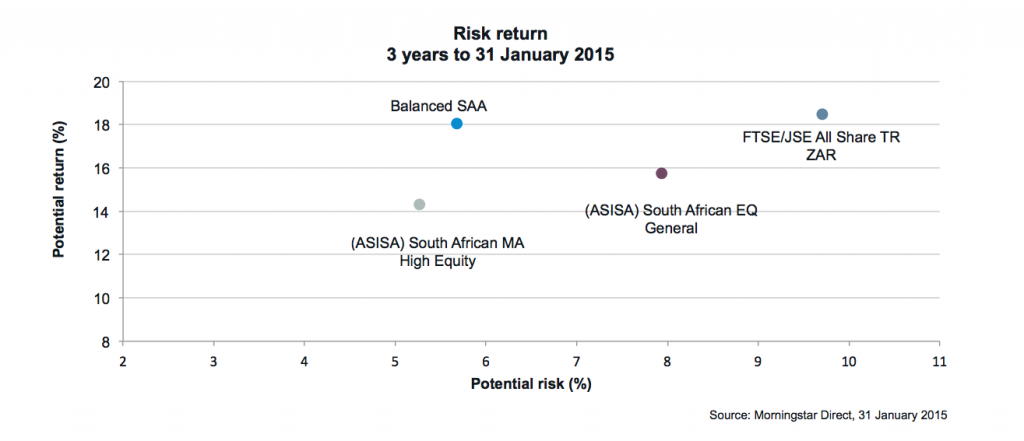

Because the fund has only 70% of its assets exposed to equity, its returns are less volatile than a pure equity fund. The scatter plot below compares the risk-return profile of the above SAA blend of indices against that of the ALSI, as well as two of the popular ASISA categories, over the past three years.

While the Balanced Fund’s strategic asset allocation (SAA) sacrificed only a small amount of performance relative to the ALSI over the past three years, the ALSI was almost double as volatile as this particular SAA blend!

2.2 Satrix Low Equity Balanced Index Fund

This Regulation 28-compliant fund aims to provide a reasonable level of income while seeking to preserve capital, in real terms with lower volatility, over the medium to long term. By design, this balanced fund with an even lower equity allocation than the Satrix Balanced Index Fund, satisfies the need for some exposure to the equity market, with excellent volatility management.

In a nutshell

Whether you’re looking for a Regulation 28 compliant fund to reduce the risk in your client’s portfolio, such as the Satrix Balanced Index Fund or the Satrix Low Equity Balanced Index Fund, or a pure equity fund that offers a low-cost value style of investing, in the form of the Satrix Dividend Plus Index Fund, passive funds have proven themselves as versatile, low-cost solutions for volatile times.

At the same time, there are also active solutions that are able to exploit volatile markets superbly. At Sanlam Investments we believe that there is a place for both active and passive solutions. Read why .

For the Satrix disclaimer, please visit http://www.satrix.co.za/disclaimer.php

Comments are closed.