“Today we live in a world with very low interest rates, which are likely to cause very low returns from global bonds and which have changed the pricing levels on all alternative asset classes,’ says Frederick White, co-manager of the Sanlam Investment Management (SIM) Balanced Fund. It is also a highly indebted world, incentivising governments to keep interest rates low, which could allow some inflation into the system. And rising protectionism could reduce trade and contribute further to inflation. It is also a world in which China’s growth is slowing and emerging markets, including South Africa, are adapting to the hardship following the downturn in the commodities cycle.

How did we get here?

In the late 1990s, while most emerging economies experienced difficulties due to many commodity prices hitting all-time lows, China emerged as a savings giant and all that savings had only one place to go – the national banks. As a result, the ruling party of China was in a position to bankroll the biggest infrastructure development in a lifetime. This lured companies from across the world to relocate production to China, accessing the cheap labour force and a massive market amid a newly-built infrastructure. Commodities soared and things started looking much better for emerging economies. BRICS became more than a buzz word – these countries had to be represented in portfolios.

In the mean time, with all the factories relocated to China, the workers class delivering manual labour in developed economies was under pressure. Real income declined. But the rich who held more of their wealth in corporates – making great profits, especially at the lower labour costs – were getting richer, sowing the seeds for the rise of the anti-establishment, much later leading to Brexit and the election of president Trump. In 2007/08 the housing bubble burst, pushing rates down and causing a search for yield and the repricing of all asset classes. In China the super cycle was over and so were the good times for emerging markets. Just like in the 1990s, fundamentals deteriorated, deficits arrived and rating downgrades became a reality.

This is a world in which growth is under pressure. Investors across the globe are desperate for a yield pick-up, but also skittish around risk and once again looking for safe havens, protecting them against downside risk. In short, they are looking for a solution that would offer ‘the best of both worlds’ – growth and protection.

What is the aim of the SIM Balanced Fund?

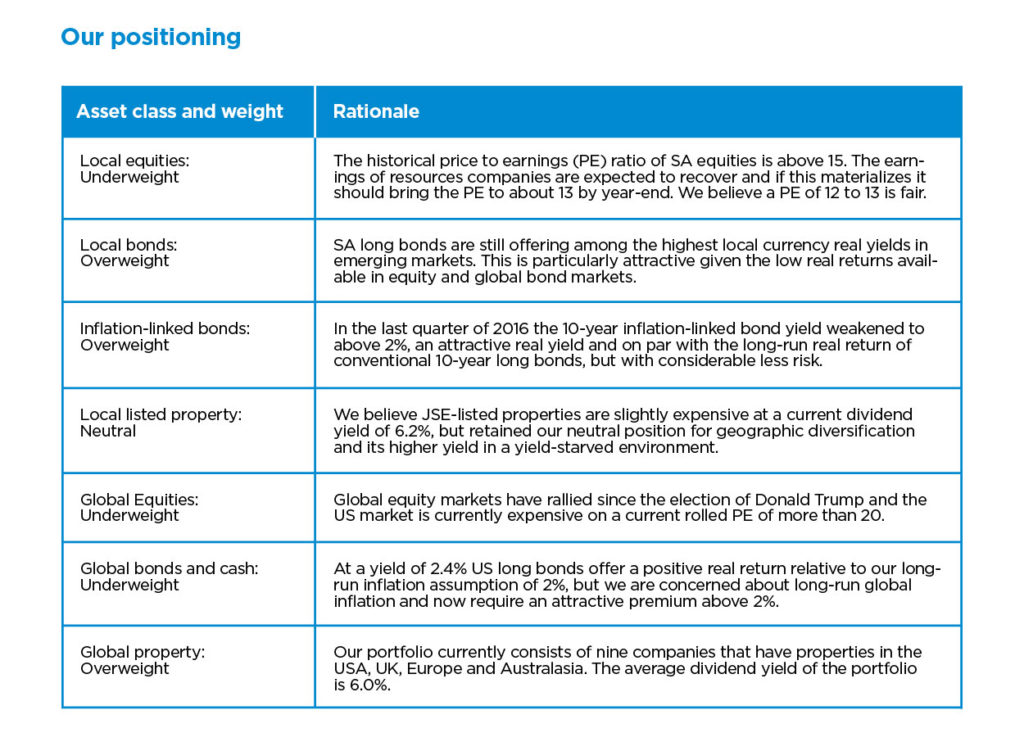

Fred says the purpose of the SIM asset allocation team is to use all the strengths of such a a large asset manager to provide a global balanced solution that represents SIM’s best view (see current positioning below). The fund aims for the best possible capital growth without taking excessive risk. The team uses a process in which information is disseminated and discussed, followed by timeous, rigorous interaction between the right people, with the necessary checks and balances in place.

How does the SIM Balanced Fund offer the best of both worlds?

By using the above process, the SIM Balanced Fund is able to offer both long-term growth and shorter-term protection. It does this by using the following:

1. A valuations-based approach

A key to downside protection is buying assets when they are priced below SIM’s assessment of fair value and only selling assets when their value is fully priced in. Although it is possible for asset prices to fall significantly after SIM has acquired the assets, buying at a sufficient margin of safety does build in a buffer and it’s not that far a stretch for asset prices to recover back to this ‘buy level’ and beyond. In contrast, buying at fair value would have meant a much longer recovery time for these asset prices.

2. Diversification

Although equities and local listed property have proven to be the stellar outperformers over the past decades, uncertainty remains and the current valuation levels of both these asset classes show that significant drawdown risks remain. As a multi asset high equity fund, the SIM Balanced Fund invests across all main asset classes, locally and globally, thereby reducing the volatility of being in equities or property only, but still providing up to 75% exposure to equity and 25% to property, building in the potential for long-term growth.

3. Derivatives

With derivatives, if you have any doubt about why, how and when to use them, they are best avoided. We have a very specific strategy using a discretionary hedge with auto-valuation trigger. In fact, so serious are we about cementing SIM’s leadership in the derivatives space and establishing a centre of derivatives expertise in the balanced space, that we appointed Ralph Thomas, a derivatives specialist, as the newest addition to the team managing the SIM Balanced Fund.

What are the minimum investment amounts?

Investors can invest from as little as R500 per month or a R10 000 lump sum.

Mandatory disclosure

All information and opinions provided are of a general nature and are not intended to address the circumstances of any particular individual or entity. We are not acting and do not purport to act in any way as an advisor or in a fiduciary capacity. No one should act upon such information or opinion without appropriate advice after a thorough examination of a particular situation. We endeavor to provide accurate and timely information but make no representation or warranty, express or implied, with respect to the correctness, accuracy or completeness of the information or opinions. Any representation or opinion is provided for information purposes only. Unit trusts are generally medium to long-term investments. Past performance of the investment in no guarantee of future returns. Unit trusts are traded at a ruling price and can engage in borrowing and scrip lending. Sanlam Investments consists of the following authorised Financial Services Providers: Sanlam Investment Management (Pty) Ltd (“SIM”), Sanlam Multi Manager International (Pty) Ltd (“SMMI”), Satrix Managers (RF) (Pty) Ltd, Graviton Wealth Management (Pty) Ltd (“GWM”), Graviton Financial Partners (Pty) Ltd (“GFP”), Radius Administrative Services (Pty) Ltd (“Radius”), Blue Ink Investments (Pty) Ltd (“Blue Ink”), Sanlam Capital Markets (Pty) Ltd (“SCM”), Sanlam Private Wealth (Pty) Ltd (“SPW”) and Sanlam Employee Benefits (Pty) Ltd (“SEB”), a division of Sanlam Life Insurance Limited; and has the following approved Management Companies under the Collective Investment Schemes Control Act: Sanlam Collective Investments (RF) (Pty) Ltd (“SCI”) and Satrix Managers (RF) (Pty) Ltd (“Satrix”). Although all reasonable steps have been taken to ensure the information in this document is accurate, Sanlam Collective Investments (RF) (Pty) Ltd (“Sanlam Collective Investments”) does not accept any responsibility for any claim, damages, loss or expense; however it arises, out of or in connection with the information. No member of Sanlam gives any representation, warranty or undertaking, nor accepts any responsibility or liability as to the accuracy of any of this information. The information to follow does not constitute financial advice as contemplated in terms of the Financial Advisory and Intermediary Services Act. Use or rely on this information at your own risk. Independent professional financial advice should always be sought before making an investment decision. Sanlam Group is a full member of the Association for Savings and Investment SA (ASISA). Collective investment schemes are generally medium- to long-term investments. Please note that past performances are not necessarily an accurate determination of future performances, and that the value of investments may go down as well as up. A schedule of fees and charges and maximum commissions is available from the Manager, Sanlam Collective Investments, and a registered and approved Manager in Collective Investment Schemes in Securities. The maximum fund charges include (including VAT): An initial advice fee of 3.42%; initial manager fee of 0.00%; annual advice fee of 1.14% and annual manager fee of 1.25%. The most recent total expense ratio (TER) is 1.62%. Additional information of the proposed investment, including brochures, application forms and annual or quarterly reports, can be obtained from the Manager, free of charge. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in the portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of the portfolio and the investor will differ depending on the initial fees applicable, the actual investment date, and the date of reinvestment of income as well as dividend withholding tax. Forward pricing is used. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. The performance of the portfolio depends on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-div date. Lump sum investment performances are quoted. The portfolio may invest in other unit trust portfolios which levy their own fees, and may result is a higher fee structure for our portfolio. All the portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No 45 of 2002. International investments or investments in foreign securities could be accompanied by additional risks such as potential constraints on liquidity and repatriation of funds, macroeconomic risk, political risk, foreign exchange risk, tax risk, settlement risk as well as potential limitations on the availability of market information. The Manager has the right to close any portfolios to new investors to manage them more efficiently in accordance with their mandates. The portfolio management of all the portfolios is outsourced to financial services providers authorized in terms of the Financial Advisory and Intermediary Services Act, 2002. Standard Bank of South Africa Ltd is the appointed trustee of the Sanlam Collective Investments Scheme. Definition of derivatives: Derivatives are instruments generally used as an instrument to protect against risk (capital losses), but can also be used for speculative purposes. Examples are futures, options and swaps.

Comments are closed.