March 2021 market overview: Inflation fears reignited

Eight years after the ‘taper tantrum’ of 2013, when the Fed signalled that it would be ending its quantitative easing programme, US long bond yields suddenly spiked in March. This time the rise was in fear that the US $1.9 trillion stimulus package might cause the return of inflation in the long term. The possibility of higher inflation was reinforced by US Federal Reserve Chairman Jerome Powell’s comment that monetary policy will remain easy and that he’s not especially concerned about inflation.

Emerging market central banks are hiking rates

Emerging market countries and their currencies are particularly susceptible to rising US inflation and capital returning to developed markets. Turkey reported consumer inflation of more than 16% for the past year. Consumer price inflation is also accelerating in Brazil, Russia, Nigeria and many smaller emerging markets. In response, the central banks of Brazil, Russia and Turkey lately increased their benchmark interest rates.

The noose is tightening around tech giants

The share prices of tech giants, such as Tencent and Alibaba, slumped after the SEC’s announcement that it’s taking steps to review the financial audits of overseas companies. Non-compliance will lead to delisting from US bourses.

Tesla and PayPal welcome bitcoin payment

After disclosing its $1.5 billion investment in bitcoin in February, Tesla signalled in March its intent to begin accepting bitcoin as a form of payment. A few days later PayPal announced that it had started allowing US consumers to use cryptocurrency to pay at millions of its global online merchants. Customers who hold bitcoin, ether, bitcoin cash and litecoin in PayPal digital wallets will now be able to convert their holdings into fiat currencies at checkout.

Ever Given free again

After nearly a week of blocking the Suez Canal, which normally carries about 12% of global trade and one million barrels of oil a day, the giant container ship Ever Given was finally freed.

SA economy lost 7% in 2020

Locally, SA’s GDP data for 2020 was released, showing the biggest decline for the country since 1920, when South Africa entered a severe post-World War I recession. SA GDP shrunk by 7% in 2020, compared with a 0.2% expansion in 2019. Despite the severity of the economic downturn, the FTSE/JSE All Share Index burst through the 68 000 level for the first time during March.

SA inflation and trade surplus at healthy levels

Other good news is that headline consumer price inflation slowed to 2.9% year-on-year, now below the Reserve Bank’s target range, making interest rate hikes within the next few months highly unlikely. South Africa’s trade surplus also widened to R29 billion and our exports increased by 16.5% on a month-on-month basis.

March favours SA and the rand

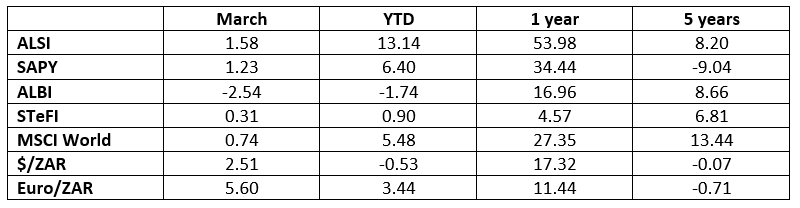

A surprisingly strong South African equity market and currency might just become the theme for 2021. For the fifth month in a row, SA equities as measured by the FTSE/JSE All Share Index (ALSI) gave a solid total return, 1.6% for March. SA listed property (as measured by the SAPY) gave 1.2%. On a sectoral basis, Basic Materials, Industrials and Financials returned 1.3%, 4.6% and 1.1% respectively. The rand strengthened 2.5% against the US dollar and 5.6% against the euro. Due to the strong local currency, the MSCI World index returned a mere 0.74% in rand terms for the month. SA bonds (ALBI) lost 2.54% and cash (STeFI) returned 0.31%.

Over the past year, resources returned 92%

It was just over a year ago that the coronavirus first arrived in Milan, sending stock markets worldwide into disarray. Since reaching the lows of 12 months ago, most markets have made a phenomenal comeback. The ALSI, for example, returned 54% for the year to end March! This is mostly powered by the Basic Materials sector, up 92.2% over the past year; Industrials and Financials are up 43.6% and 36.95% respectively. March 2020 was one of the worst months in the history of listed property (-33% in one month) but with that horrendous figure now left behind when calculating the one-year return to 31 March 2021, property is looking deceptively respectable at 34.44% for the past year. The ALBI returned 16.96% for the year, and cash gave 4.6%. The rand strengthened 17.3% against the US dollar and 11.4% against the euro over the 12 months to end March. The MSCI World Index gave South African investors 27.35% in rand terms.

Over five years, world equities beat local equities

Over the past five years to March 2021, the ALSI returned 8.2% p.a. On a sectoral level, Basic Materials returned 23.4% per year. In contrast, Industrials and Financials lost 2.15% and 1.85% respectively per year. As the worst performer over this period, listed property (the SAPY) returned -9% annualised over the past five years. Bonds, as measured by the ALBI, at 8.7% returned more than local listed equities. Cash gave 6.8% p.a. on average over the past five years. The MSCI World Index (developed market equities) gave a 13.4% p.a. total return in rand terms over the past five years, comfortably beating all major SA asset classes. SA consumer inflation averaged 4.4% p.a.

Table 1: Total returns to 31 March 2021

Source: Morningstar | Total returns annualised to 31 March 2021

Comments are closed.