Factor investing: what it is and how to use it

Part 1/10: UNDERSTANDING what drives performance in your portfolio

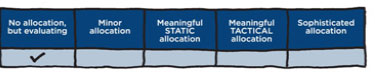

Client level of adoption/allocation:

This is the first in a series of articles by Jason Swartz from Satrix, discussing practical ways to use factor investing when evaluating or building portfolios.

In this article we won’t be using factor investing explicitly. Instead, we’ll be using a mathematical framework to find out how much of an active portfolio’s performance comes from so-called style factors, for example ‘Momentum’, ‘Value’ or ‘Quality’, and how much comes from pure outperformance, also known as ‘alpha’.

This evaluation is important, because many traditional active managers deliver a significant percentage of their active returns via static exposures to factors (see figure 1). This phenomenon has less to do with the fact that factor strategies are implemented in a passive way, but more to do with factor strategies having the same ideology as active managers with respect to exploiting market inefficiencies and aiming to outperform the market.

With factors constructed to have characteristics which historically explain excess returns, active managers typically embed these characteristics in their investment process through well-known strategies such as Value, Momentum, Quality, Size and Low Volatility [See Figure 1]. A useful exercise, and the subject of this article’s application, is to understand which combination of these factors is needed to best replicate an active manager’s return through time [See Figure 2] .

With factors constructed to have characteristics which historically explain excess returns, active managers typically embed these characteristics in their investment process through well-known strategies such as Value, Momentum, Quality, Size and Low Volatility [See Figure 1]. A useful exercise, and the subject of this article’s application, is to understand which combination of these factors is needed to best replicate an active manager’s return through time [See Figure 2] .

This analysis provides valuable insight into whether the active manager incurs style drift through changing exposure (intentionally or inadvertently) to the underlying factors. In our example we see active managers’ apparent drift toward Momentum during 2008 and Quality during 2011. This insight could reveal to an investor or financial planner whether the active manager is being consistently ‘true to label’ versus its claimed investment style.

Another component of using factor investing to evaluate a portfolio’s performance is benchmarking. Given the framework discussed above, one could break down the expected return of a portfolio into:

1) the return relative to an appropriate benchmark;

2) the active return from the portfolio’s exposure to a mix of factors; and

3) the pure alpha, i.e. the active return above static exposures to factors.

By breaking down a portfolio’s return into the above components when attributing performance, an investor or portfolio manager is able to properly evaluate the true value the active manager is adding relative to its fees charged. Because pure alpha is rare and more expensive, it is important to understand how much the active manager is adding to the portfolio’s return beyond factor exposures.

Comments are closed.