Exactly how much tax will a tax-free account save?

In 2015 National Treasury introduced tax-free savings accounts to reignite a savings culture among South Africans. Designed to encourage long-term savings while giving you access to your funds at any time, these accounts offer flexibility and tax savings, and unsurprisingly the take-up has been good. Still, many South Africans hold long-term savings in standard, taxable accounts – either because they are oblivious of these new tax-free products or because they are not aware exactly how much tax a tax-free account will save them.

How does a tax-free savings account work?

All the proceeds of a tax-free savings account (TFSA), be it (local) dividends, interest or capital gains, are tax-free.

However, your overall contributions per tax year is currently limited to R36 000. Any contributions exceeding the annual cap will be taxed at 40%. You will therefore have to manage your overall contributions to all your TFSAs combined carefully to make sure you remain within the limit. Unused amounts may not be rolled over. So it’s a case of ‘use it, or lose it’.

Other than the annual limit, a lifetime contribution limit of R500 000 also applies. But don’t be alarmed if the value of your account, with all interest, dividends and capital gains over the years, starts to top R500 000. That’s not the figure being monitored by SARS. Only the sum of your contributions over the years may not exceed R500 000, and dividends being reinvested inside a product do not count as contributions.

Are the tax benefits worth opening a new account?

The benefit may be small during the first few years, but as the value of the investment grows, it becomes significant.

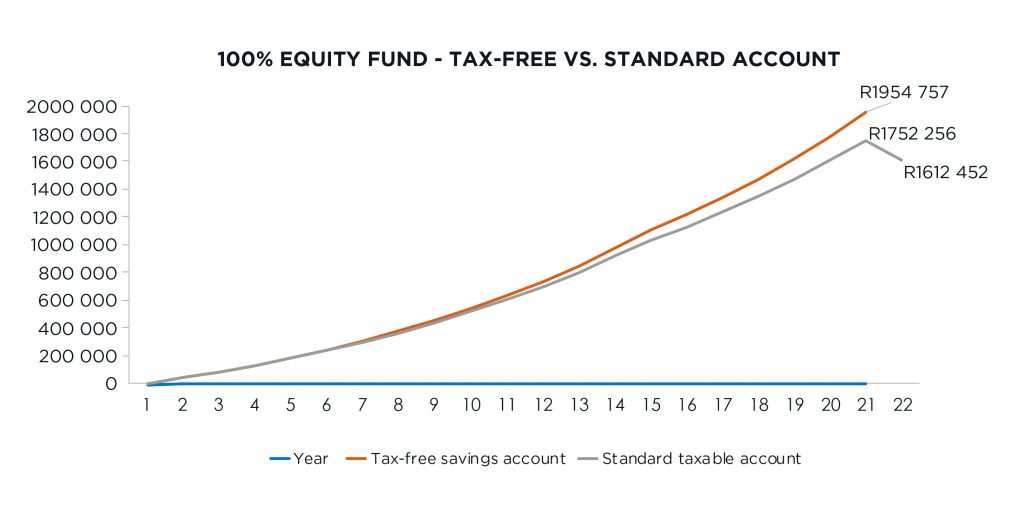

Let’s take an investor in a 100% equity fund as an example:

An aggressively risk profiled investor chooses a 100% equity fund for her TFSA. Staying within SARS’ contribution limits, she invests R36 000 per tax year for the first 13 years and R32 000 in the 14th year. Because the product is part of her long-term financial plan, she leaves the money in the account for another six years. At the end of 20 years, assuming 4% in dividends every year and 6% in capital growth, her TFSA will be worth R1 954 757 compared to R1 752 256, had she left it in a standard, taxable account where 20% dividends withholding tax was subtracted every year by the administrator. That’s a cumulative tax saving of more than R200 000 over 20 years!

But that’s not where the benefit ends. Should she then withdraw the money after 20 years, no capital gains tax is payable. In the standard, taxable account – assuming she’s in the 45% tax bracket – she would have owed SARS R139 804 in capital gains tax, leaving her with only R1 612 452 in her pocket.

In total, after 20 years, an equity investor’s decision to invest the same amount of money in a TFSA instead of a standard, taxable account has saved her R342 305.

Figure 1: Tax saved by an equity investor in a TFSA

Assumptions: Investor is in the 45% tax bracket | equity fund grows by 10% per year (4% dividends; 6% capital growth)

Source: Sanlam Investments | 1 February 2021

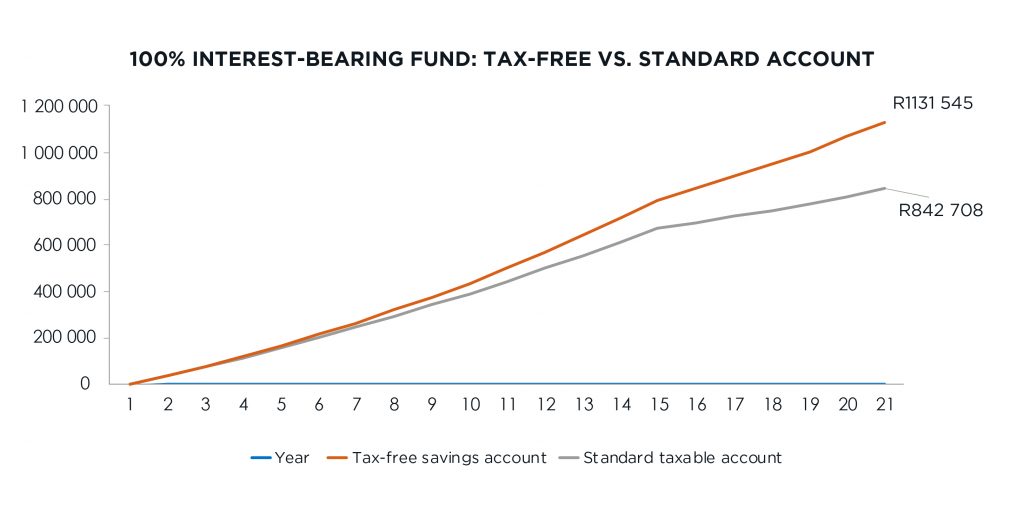

Let’s also take an investor in a 100% money market fund as an example:

A more conservative investor is in the mid-income tax bracket of 36%. He chooses a 100% interest-bearing or money market fund for his TFSA. Staying within SARS’ contribution limits, he invests R36 000 per tax year for the first 13 years and R32 000 in the 14th year. He stays invested in the product for 20 years. At the end of 20 years, assuming 6% in interest every year, his TFSA will be worth R1 131 545 compared to R842 708, had he left it in a standard, taxable account. That leaves him with a third more in his TFSA than what a taxable account would have been worth after tax on interest earned. (For our calculations we assumed his R23 800 annual interest exemption was used elsewhere in his portfolio.)

Figure 2: Tax saved by a money market investor in a TFSA

Assumptions: Investor is in the 36% tax bracket | fund pays interest of 6% per year | annual exemption of R23 800 is used elsewhere in his portfolio

Source: Sanlam Investments | 1 February 2021

If the investor’s marginal tax rate was 45%, the tax saving would have been even higher.

The short answer is, yes, the significant tax saving is definitely worth the little paper work to open a tax-free savings account (TFSA).

Which TFSA products does Sanlam Investments offer?

Sanlam Investments offers three tax-free products. They are the:

• Sanlam Collective Investments tax-free unit trusts

• Satrix tax-free unit trusts

• Satrix tax-free ETF range.

The Sanlam Collective Investments tax-free unit trust is for investors who prefer actively managed funds, run by portfolio managers who research and analyse the investment universe before picking only certain assets within an index.

The Satrix tax-free funds are for those who prefer low-cost index-tracking investments (the portfolio manager buys all the assets in your chosen index). Satrix unit trusts and Satrix ETFs are available via the SatrixNOW.co.za platform, which has no minimum investment amount and you can therefore invest from as little as a few cents per month. Investing online also cuts out the paper work often associated with opening a new account.

Investors have one month left to use this tax year’s R36 000 allowance

The current 2020/21 tax year ends on 28 February 2021, creating some kind of urgency if you still want to use your R36 000 allowed contribution for this year. But, should you miss the deadline, then rather start in March than never. The above graphs show not only how much tax a tax-free savings account could potentially save you, but also the power of compounding. The sooner you open a TFSA, the sooner the power of compound returns can start working in your favour. Even better when those returns are tax free.

Comments are closed.