Brexit Rocks Global Markets

By Rafiq Taylor, Portfolio Manager and Head of Retail Implemented Consulting, Sanlam Multi Manager

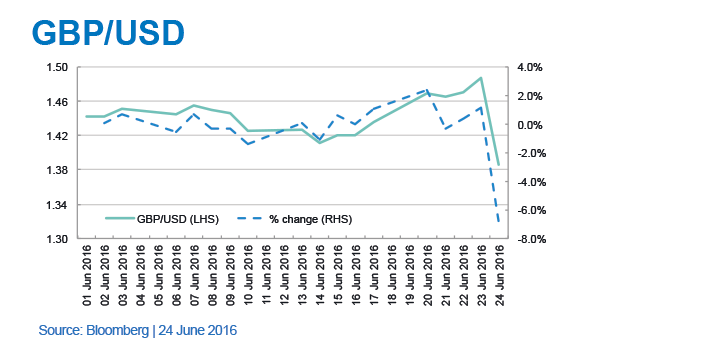

On 23 June, British citizens voted on whether Great Britain should remain part of the European Union, a community they’ve been a member of for over 40 years. On Friday morning the Leave campaign stole a narrow victory (51.9% to Leave and 48.1% to Stay), despite market consensus building up to the vote that we would likely see the UK remain in the EU. This resulted in a large amount of volatility in the currency and global equity markets. The British Pound (GBP) as well as stocks with GBP exposure were particularly affected as uncertainties surrounding the future of many of these businesses with operations in the UK was placed into the spotlight.

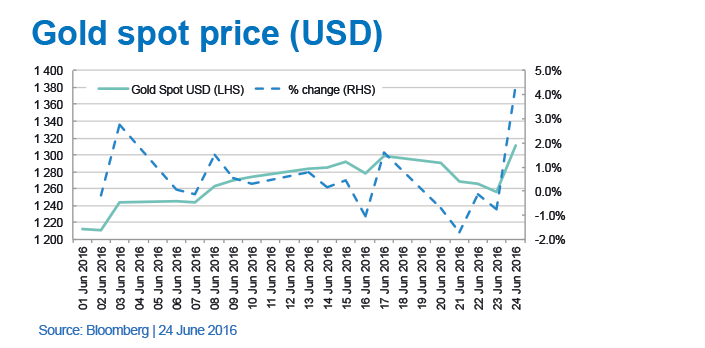

While most stocks have struggled, there have been areas of the markets which have done well following the news. US treasury bonds strengthened while gold companies and the spot price of gold rose handsomely, all on the back of a global flight to safety.

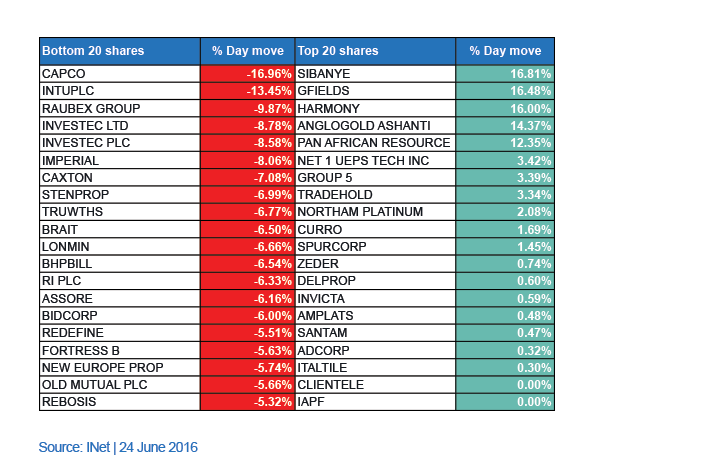

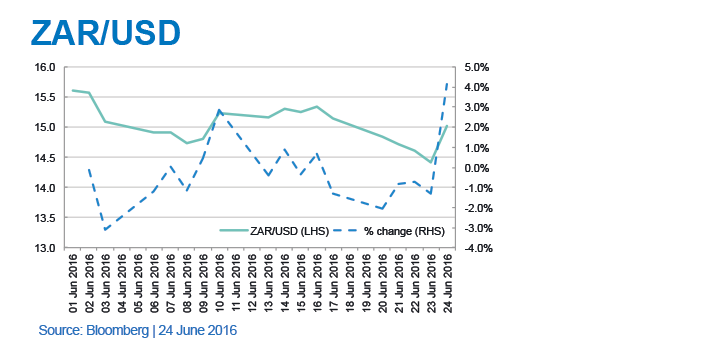

Locally, we’ve similarly seen a broad sell-off, with gold counters such as Sibanye, Goldfields and AngloGold some of the handful of stocks whose share prices are trading higher. Property fell, with rand hedge counters such as Intu (INTUPLC) and Capital and Counties (CAPCO) especially hard hit. The following shares recorded the biggest initial price moves in the local market*:

*As at midday, 24 June 2016.

Bonds also weakened significantly, falling over 3% initially, but strengthening as markets approached midday.

Over the last few months, much has been written and spoken about the potential for a Brexit to occur as well as many of the repercussions for the UK, Europe and global growth in general. Brexit has also raised new market uncertainties:

- Will Scotland seek another referendum on whether to remain a part of the UK?

- Will Northern Ireland also look to have a referendum on UK membership?

- Will other European Union nations look to hold similar referendum votes?

- How will European leaders provide comfort to their citizens to retain membership in the Union?

- How will this affect global growth and in the region in general, and will this lead to contagion risk in global markets?

- What will the effect be on immigration across the UK and Europe?

- How does this affect interest rates globally, particularly in the US where they have been eager to raise rates?

These are merely some of the potential risks and uncertainties that have been raised by economists globally. What is certain, however, is that volatility will persist amidst the lack of stability in the short to medium term in the region.

Over the last few months, we discussed the possibility of a Brexit in many our investment committee meetings. This, along with many other risks still prevalent in markets, has informed our more cautious view. As such, we’ve looked to increase exposure to more defensive managers and strategies. The amount of volatility following the fallout again emphasizes the importance of having the flexibility to protect investors from these swings in asset prices and also to potentially capture opportunities where stocks have been oversold.

We therefore retain conviction in our current managers’ ability to manage through this volatility. In these times of market turmoil, investors need to remind themselves of their long term investment objectives and stay the course.

Disclaimer: Sanlam Multi Manager International is an authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act (FAIS) 2002.

Comments are closed.