A consistent performer, no matter the cycle

In an era of volatility and uncertainty, the world of investing often resembles a labyrinth of indecision and changing goal posts. Even the most focused investors can find themselves caught up in external noise and emotion, resulting in them questioning their investment choices.

During periods of volatility, investors need to be able to depend on funds that have proven their ability to reduce drawdowns and potential capital loss. Volatility therefore requires effective tactical asset allocation. The Sanlam Investment Management (SIM) Inflation Plus Fund meets this need.

Focused on protecting capital

The SIM Inflation Plus Fund falls under SIM’s Absolute Return strategy. The Absolute Return strategy at SIM is designed to offer explicit capital protection through the application of derivative strategies, enhancing the implicit capital protection of diversifying across asset classes.

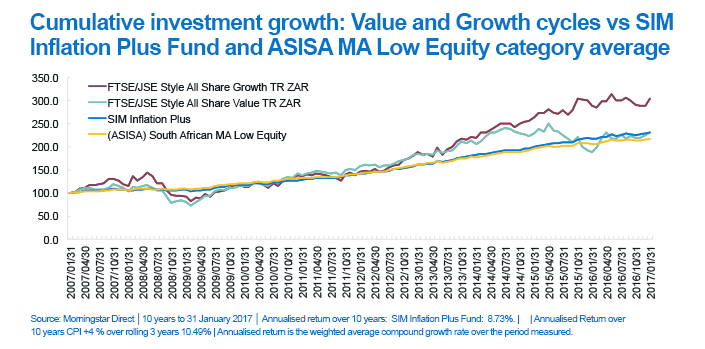

Historically the market has gone through cycles when growth outperformed, but also periods when value outperformed. Risk-conscious investors that prefer consistency and a level of stability have a poor investment experience across changing market cycles if they choose a fund that does not meet their risk profile and desired investment outlook. The SIM Inflation Plus Fund provides a possible solution for investors that want consistency during and through changing markets. It has proven its ability to deliver a stable return profile, regardless of volatility and fluctuating market cycles. For example, the minimum 12-month return for the Fund has been 1.81% over the past 10 years (and the maximum has been 13.41%). Therefore, no one investing in the fund at any point over the past 10 years and staying invested for at least 12 months would have experienced a negative return over any 12-month period.

Stability through different cycles

The graph below illustrates that irrespective of which investment style is doing well, the SIM Inflation Plus Fund is designed to deliver a consistent level of return. Note we are not comparing the return of the Fund to that of the equity indices, but rather highlighting the stability of the level of return regardless of whether value or growth markets are trending.

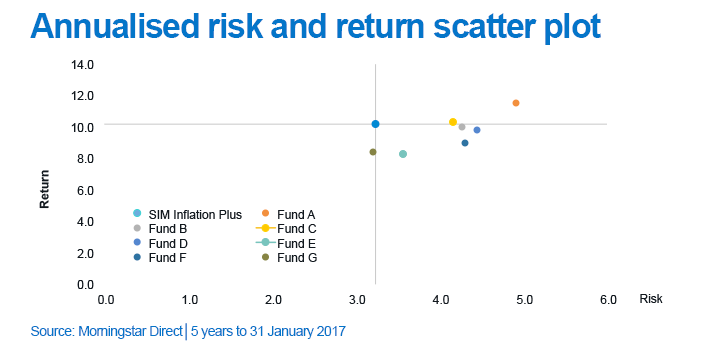

Volatility is minimal compared to peers

When managing the SIM Inflation Plus Fund, the portfolio managers follow a risk-conscious approach and therefore the Fund is able to provide competitive downside protection and defends well during market weakness relative to most peers within the ASISA Multi Asset Low Equity category. Volatility is kept at a minimum by focusing on the risk/return budget of every single asset class.

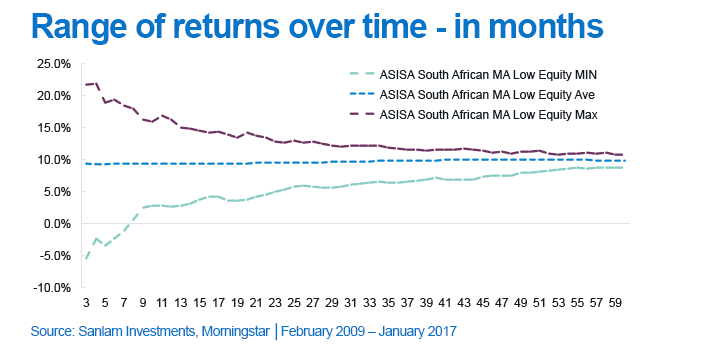

Over time certainty increases

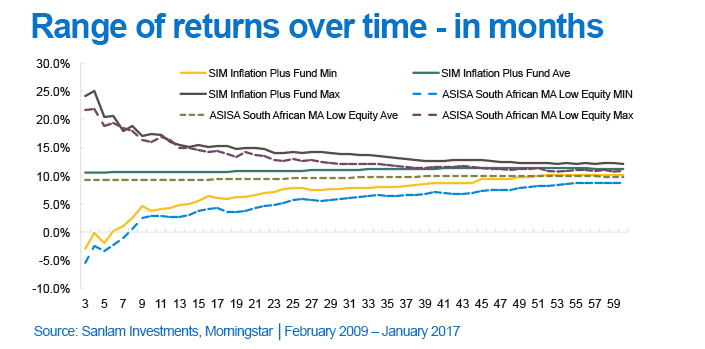

The graph below shows the range of returns experienced in the ASISA Multi Asset Low Equity category over the stated investment periods. Over shorter periods of time the returns within the category have a much wider range. However, as we increase the investment period (i.e. moving towards the right) the funnel starts to close in, approaching the ‘average return’ area. The returns of the Fund become more certain or less variable as we increase the investment period.

If we plot the SIM Inflation Plus Fund graph on the same axis we see that relative to the category, the minimum point of the range of returns that you could experience while investing in the Fund is consistently above that of the category minimum. Similarly the maximum and average returns that the Fund has historically given are also above that of the category.

At Sanlam Investment Management we believe the journey of your return experience is important. We understand that there will be times of market uncertainty and volatility – the SIM Inflation Plus Fund is designed and managed to give investors a level of stability during those times.

The stability of the fund is independently recognised

The Morningstar Awards have recognised the stability of the SIM Inflation Plus Fund by including the Fund in its shortlist of only two finalists in the Best Cautious Allocation Fund category. What makes this achievement even more remarkable is that it’s the only fund out of the qualifying universe of 83 funds to be nominated as a finalist in this category in both 2016 and 2017. With these awards, Morningstar honours funds that added the most value for investors against their peer group. The one-, three- and five-year returns of all eligible funds are adjusted for downside-biased risk to award funds that protect the capital of investors. Says portfolio manager Philip Liebenberg, ‘Capital protection is a key objective of the fund and it is gratifying to be recognised by the industry for our ability to differentiate ourselves in that respect.’

Mandatory disclosure

All information and opinions provided are of a general nature and are not intended to address the circumstances of any particular individual or entity. We are not acting and do not purport to act in any way as an advisor or in a fiduciary capacity. No one should act upon such information or opinion without appropriate advice after a thorough examination of a particular situation. We endeavor to provide accurate and timely information but make no representation or warranty, express or implied, with respect to the correctness, accuracy or completeness of the information or opinions. Any representation or opinion is provided for information purposes only. Unit trusts are generally medium to long-term investments. Past performance of the investment in no guarantee of future returns. Unit trusts are traded at a ruling price and can engage in borrowing and scrip lending. Sanlam Investments consists of the following authorised Financial Services Providers: Sanlam Investment Management (Pty) Ltd (“SIM”), Sanlam Multi Manager International (Pty) Ltd (“SMMI”), Satrix Managers (RF) (Pty) Ltd, Graviton Wealth Management (Pty) Ltd (“GWM”), Graviton Financial Partners (Pty) Ltd (“GFP”), Radius Administrative Services (Pty) Ltd (“Radius”), Blue Ink Investments (Pty) Ltd (“Blue Ink”), Sanlam Capital Markets (Pty) Ltd (“SCM”), Sanlam Private Wealth (Pty) Ltd (“SPW”) and Sanlam Employee Benefits (Pty) Ltd (“SEB”), a division of Sanlam Life Insurance Limited; and has the following approved Management Companies under the Collective Investment Schemes Control Act: Sanlam Collective Investments (RF) (Pty) Ltd (“SCI”) and Satrix Managers (RF) (Pty) Ltd (“Satrix”). Although all reasonable steps have been taken to ensure the information in this document is accurate, Sanlam Collective Investments (RF) (Pty) Ltd (“Sanlam Collective Investments”) does not accept any responsibility for any claim, damages, loss or expense; however it arises, out of or in connection with the information. No member of Sanlam gives any representation, warranty or undertaking, nor accepts any responsibility or liability as to the accuracy of any of this information. The information to follow does not constitute financial advice as contemplated in terms of the Financial Advisory and Intermediary Services Act. Use or rely on this information at your own risk. Independent professional financial advice should always be sought before making an investment decision. Sanlam Group is a full member of the Association for Savings and Investment SA (ASISA). Collective investment schemes are generally medium- to long-term investments. Please note that past performances are not necessarily an accurate determination of future performances, and that the value of investments may go down as well as up. A schedule of fees and charges and maximum commissions is available from the Manager, Sanlam Collective Investments, and a registered and approved Manager in Collective Investment Schemes in Securities. The maximum fund charges include (including VAT): An initial advice fee of 1.14%; initial manager fee of 1.14%; annual advice fee of 1.14% and annual manager fee of 1.14%. The most recent total expense ratio (TER) is 1.25%. Additional information of the proposed investment, including brochures, application forms and annual or quarterly reports, can be obtained from the Manager, free of charge. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in the portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of the portfolio and the investor will differ depending on the initial fees applicable, the actual investment date, and the date of reinvestment of income as well as dividend withholding tax. Forward pricing is used. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. The performance of the portfolio depends on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-div date. Lump sum investment performances are quoted. The portfolio may invest in other unit trust portfolios which levy their own fees, and may result is a higher fee structure for our portfolio. All the portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No 45 of 2002. International investments or investments in foreign securities could be accompanied by additional risks such as potential constraints on liquidity and repatriation of funds, macroeconomic risk, political risk, foreign exchange risk, tax risk, settlement risk as well as potential limitations on the availability of market information. The Manager has the right to close any portfolios to new investors to manage them more efficiently in accordance with their mandates. The portfolio management of all the portfolios is outsourced to financial services providers authorized in terms of the Financial Advisory and Intermediary Services Act, 2002. Standard Bank of South Africa Ltd is the appointed trustee of the Sanlam Collective Investments Scheme. Definition of derivatives: Derivatives are instruments generally used as an instrument to protect against risk (capital losses), but can also be used for speculative purposes. Examples are futures, options and swaps.

Comments are closed.