5 Top Trends Facing Investment Industry

Continuing economic uncertainty and volatility in financial markets has led to the emergence of new trends, challenges and opportunities impacting both the global and the local investment industry. We have identified five key trends currently shaping the industry:

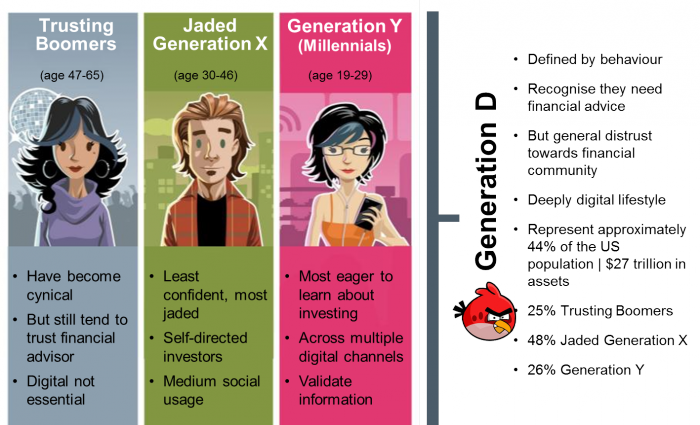

The “angry client”: Clients no longer have the same trust in financial professionals than was the case in past years. A new generation of clients now looks to social networks and digital media to source information and make financial decisions. Financial professionals face a crucial challenge – to change the perceptions of “angry clients” and build trust once more. The focus of financial professionals should be on educating clients, ensuring they have all the relevant information and understanding before making investment decisions.

A low-return investment environment: In contrast to earlier years, investors are currently experiencing a low-return investment environment in which the challenge is for traditional asset classes to realise attractive returns outperforming inflation.

The investment industry has reacted to this low-return, low-trust environment in the following ways:

The “route to good”: The past few years have witnessed the emergence of a new breed of philanthropist capitalists – companies who focus not only on making a profit but also giving back to the community in corporate social investment programmes. Investors are increasingly looking not only at the bottom line of companies but also whether they are a force for social good.

Pressure on margins: Cost and fee pressures continue to have a significant impact on the investment industry, affecting everyone from financial advisers, asset managers and administrative companies to management committees. Lower fees are no longer a negotiable factor.

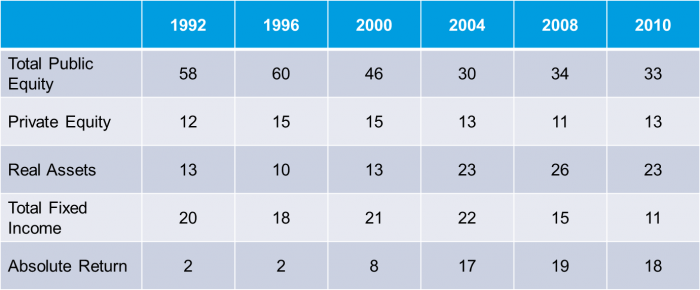

Alternative sources of alpha: In a low-return and low-trust environment, asset managers need to continuously identify alternative sources of alpha. To grow wealth for their clients, managers have an obligation to be innovative in a world that will in all likelihood become even more regulated in future. The US university endowment funds tend to lead the pack in terms of finding alternative sources of alpha and, as the table below shows, they have been moving away from listed equity and allocating bigger proportions of their portfolios to real assets, such as timber, and absolute return funds (funds we know as hedge funds).

US university endowment asset allocations

Source: Harvard University

These trends and other key issues redefining the investment landscape will be unpacked at the African Cup of Investment Management conference to be held at the Westin Hotel. Topics include how investors should approach currency investment, retirement and savings reform, opportunities in African private equity, and generational attitudes to investing.

Comments are closed.