The seen and unseen rewards of a retirement annuity

More than just the tax refund

Retirement annuities may sound boring – until they’re the reason you get a tax refund every year. As the cork hits the ceiling and celebratory drinks flow, few spare a moment to toast this investment product that’s still unfairly associated with commission-driven agents. Truth is, the modern retirement annuity (RA) is flexible – stop and re-start your premiums as you please. And they’re versatile, allowing you to pick from a wide range of unit trusts and ETFs. And South Africans now have plenty of low-cost retirement annuities to choose from. While the tax refund is the most obvious reward for investing in an RA, there are several other benefits.

The immediate benefit – a refund within a year of adding money to your RA

The most visible benefit of a retirement annuity is the tax refund it unlocks for you. How does the refund work? You can contribute up to 27.5% of your total income – salary, bonus, commission, interest earned, business income and rental income – to any retirement fund, such as an RA, and SARS will deduct your contributions (capped at R350 000) from your income to calculate how much tax you should have paid in a tax year. Because your payroll administrator wouldn’t have known about your private RA contributions, they most likely deducted too much tax from your salary over the year. SARS will reimburse you for this in the form of a tax refund after you’ve filed your tax return.

Alternatively, if you don’t want to wait until after you’ve filed your tax return to benefit from your RA, you can send your payroll administrator proof of your monthly RA contributions and ask them to adjust your PAYE tax so you pay less tax every month. Your tax refund is then effectively paid out to you monthly in the form of a higher net salary in your bank account.

We’ve designed this tax refund infographic to give you an idea of the size of your refund when you contribute 15% of your total income to an RA in the 2021/22 tax year. For example, if your total income for this year was R500 000 and you put 15% of that into an RA, you can expect tax relief of R24 875.

The discreet gift – no tax while your money stays in the RA

In addition to the refund, investors also enjoy the benefit of not being taxed while they remain invested in their RA. The net benefit of the tax refund is much debated, as the deal with the taxman is that you will one day have to pay tax on the money you draw in retirement. So, where SARS gave with the one hand (refund), it will take with the other in retirement (annuity income). But the benefit of not paying any investment-related tax for all those years you remain invested in an RA is undisputed. This discreet gift by SARS is actually overlooked by many investors and it’s significant when measured over decades.

While your money stays in the RA it operates similarly to a tax-free savings account (TFSA). You will pay zero tax on the dividends, interest, and any rental income earned by the fund. And one day when you withdraw your allowable lump sum of up to one-third of the market value at retirement, you’ll pay no capital gains tax.

We’ve calculated how much tax you save over 30 years if you contribute R120 000 per year to an RA instead of depositing the money into a normal taxable high-equity balanced fund. These calculations ignore the additional benefit of your annual tax refund and focuses only on what you save on your RA account. If your marginal income tax rate stayed 36% over that time, you would have saved more than R3 million in tax on investment income! And your capital gains tax saving would be nearly R1 million. These are the often overlooked rewards of an RA – in addition to the annual tax refund.

Chart 1: Investing in a high equity fund – inside an RA vs normal taxable product

Source: Sanlam Investments | Feb 2022

Source: Sanlam Investments | Feb 2022

Pay-back time – tax once you start withdrawing from your RA

Once you reach the age of 55, you’re legally allowed to retire from your RA, or some or all of your RAs, if you have more than one. There’s no maximum age at which you must retire and you could therefore retire from your RA as late in life as you want to.

As mentioned earlier, up to one-third of the market value may be taken in cash on retirement and the first R500 000 is taxed at 0% and the rest according to the table below.

Table 1: Retirement lump sum taxation

| Taxable income (R) | Rate of tax (R) |

| 1 – 500 000 | 0% of taxable income |

| 500 001 – 700 000 | 18% of taxable income above 500 000 |

| 700 001 – 1 050 000 | 36 000 + 27% of taxable income above 700 000 |

| 1 050 001 and above | 130 500 + 36% of taxable income above 1 050 000 |

| Source: SARS | February 2022 |

This is a lifetime allowance, though. If you have withdrawn any money from your company retirement fund on changing jobs or subsequently from a preservation fund earlier in your life, you might have used all or part of your zero-rated R500 000 already. It would be wise to first check with SARS how much you have used before deciding on the size of your cash withdrawal when you retire.

If at any point you contributed more than the annual limit of 27.5% of your income (or R350 000) to your retirement products, the excess above the limit will be kept on record by SARS and tax relief will be applied in future years when you contribute less than the 27.5% limit. Should there be a balance left of these excess non-qualifying contributions (they never had a chance to qualify for tax relief), you can also take that tax free in cash on retirement, since you never received a tax refund for these amounts.

With the remaining portion of your market value it’s compulsory to buy an annuity income, which will be taxed according to the SARS income tax tables. Below you can get an idea of the size of the tax amount currently payable at various income levels, depending on your age group.

Table 2: Income tax at various levels of income and different age groups

| Annual income | Tax for under 65s | Tax for 65-75 year olds | Tax for over 75s |

| R240 000 | R29 390 | R20 777 | R17 906 |

| R360 000 | R61 700 | R53 087 | R50 216 |

| R480 000 | R99 525 | R90 912 | R88 041 |

| R600 000 | R142 725 | R134 112 | R131 241 |

| R720 000 | R189 117 | R180 504 | R177 633 |

Source: SARS | February 2022

The smaller your required income, the smaller the effective tax rate that applies to you. And those over 65 enjoy an additional secondary rebate, while those over 75 can also count on a tertiary rebate, bringing the tax amount down even further.

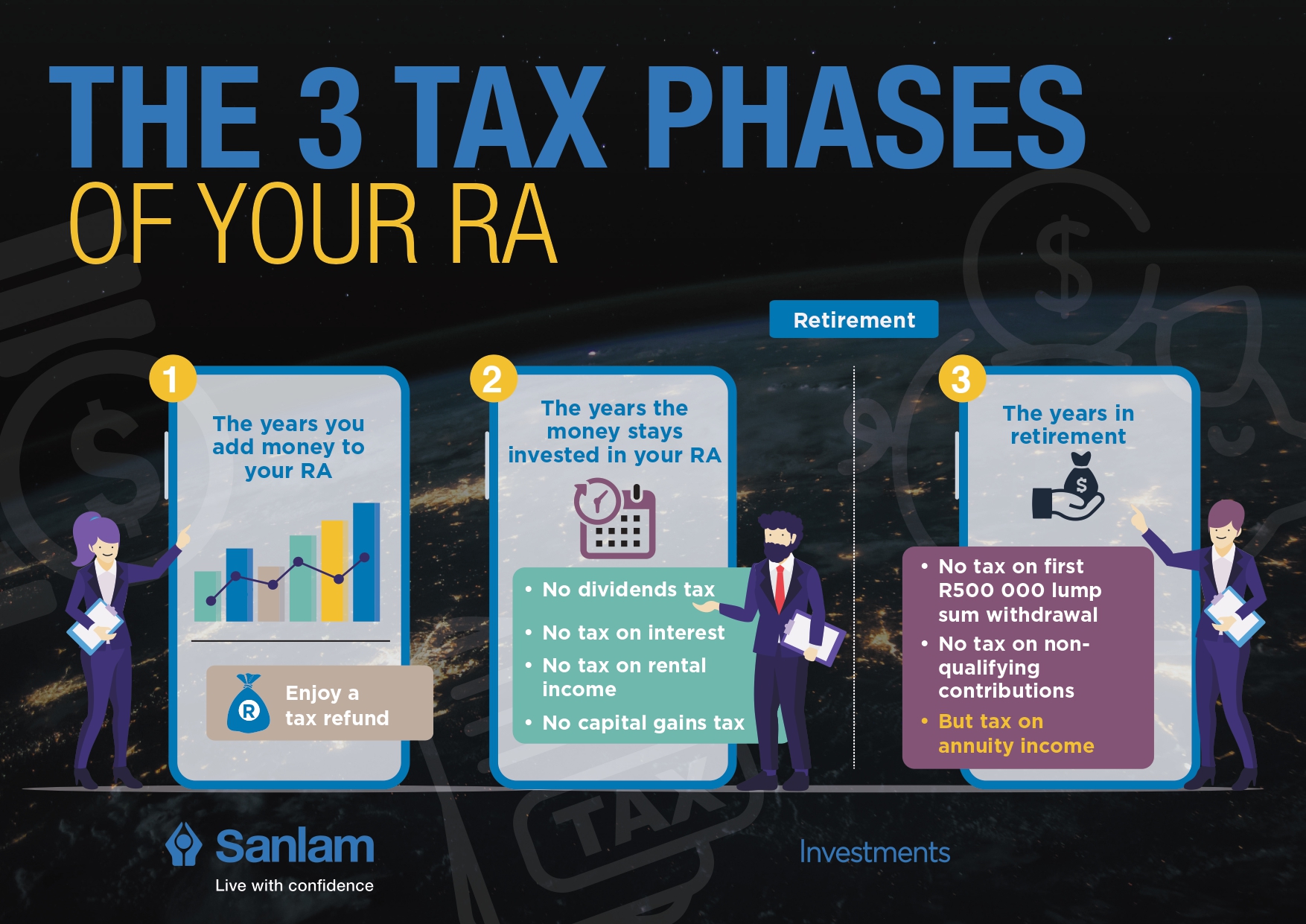

Our RA tax infographic below summarises the tax applicable at different stages of your retirement savings journey: the years you contribute; the years that money stays invested and grows and earns an investment income; and your retirement years. While the refund years may have you polishing your finest glasses, it’s the millions in tax saved over decades of staying invested in an RA that’s the real cause for celebration.

Comments are closed.