March 2020 market overview

SA placed in a recession

At the start of March, the South African economy had officially tumbled into a recession. This was following GDP data that showed a 1.4% drop in the fourth quarter of 2019, after a contraction of 0.8% in the third quarter – South Africa’s third recession since 1994. The rand deteriorated significantly as the month progressed, ending at almost R18 to the dollar.

Business confidence index drops and wage increases freeze

After the first case of the coronavirus was announced in South Africa on March 5, President Cyril Ramaphosa cautioned the country to practise social distance. By March 11 the World Health Organisation had declared the rapid spread of the virus a pandemic and cases escalated rapidly, crippling supply chains and business operations. The RMB business confidence index (BCI), compiled by the Bureau for Economic Research, stood at 18 points for the first quarter of 2020, down 8 points from the fourth quarter of 2019. Larger companies started feeling the pressure as well and the South African government informed labour unions that the wage increases, previously agreed to for the beginning of April, had to be scrapped.

World banks decrease interest rates

Increased Covid-19 cases in New York led the Fed to slash its key interest rate by half a point to a range of 1.0% to 1.25% in an effort to minimise risks to economic activity and by mid-month further cuts left the target range at 0% to 0.25%. The Bank of England also cut interest rates by 25bps, the first cut outside the Bank’s normal schedule since the 2008 financial crisis and taking it back to the record low it reached after the 2016 Brexit referendum. In a further attempt to control the global spread of the virus many countries implemented travel bans, and global equities plummeted after President Trump announced a travel ban on Europe. As a result, Wall Street had its worst daily crash since 1987 and some European markets showed the biggest losses on record ever.

South Africa followed suit, with the South African Reserve Bank’s monetary policy committee unanimously deciding to cut the repo rate by 100bps, the biggest cut in more than a decade. A bond-buying programme was also launched to support demand in credit markets as the coronavirus epidemic, Moody’s downgrade and the oil collapse weigh on the country’s economy.

Sasol on the losing side of the oil war

Saudi Arabia cut oil prices by the biggest margin in 20 years after a failed agreement with Russia over oil production. Brent crude came down steadily from 35$ to $21 a barrel over the month, a level few producers could contend with. As a result, Sasol lost over 45% of its share price value immediately after the oil price collapse. By month end, oil slumped to a 17-year low as coronavirus lockdowns cascaded through the world’s largest economies, leaving the market overwhelmed by cratering demand and a ballooning surplus of crude.

Markets close lower as countries lock down

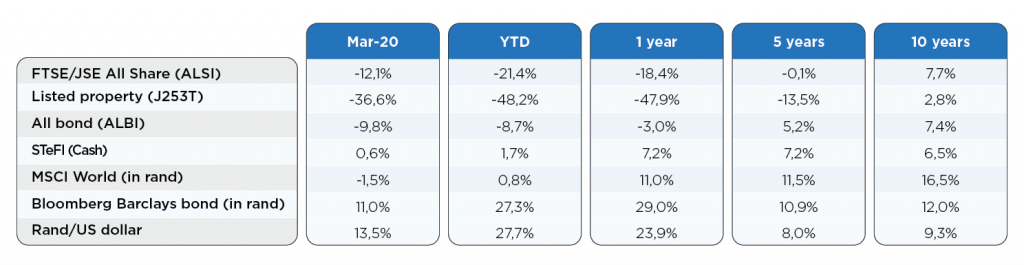

The FTSE/JSE All Share Index (ALSI) lost 12.13% on a total return basis, while property investors – just when they thought it couldn’t get any worse after February’s 15.69% loss – surrendered another 36.57% (SAPY)! The All Bond Index (ALBI) returned -9.75%, and cash returned 0.57%. During March 2020 the rand weakened by 13.53% against the dollar and by 13.41% against the euro. Taking into account the currency movement, the MSCI World Index returned -1.50% in rand terms; the Bloomberg Barclays Global Aggregate Bond Index gained 10.99% in rand terms, but only because of rand weakness (in dollar terms the return was negative too).

All asset classes – bar cash – buffeted in 2020

The ALSI has given up 21.38% for 2020 year-to-date on a total return basis – still nothing compared to the SAPY’s abysmal -48.15% in the last three months. The ALBI returned -8.72%, and cash returned 1.69%. Year-to-date the rand has weakened by 27.72% against the dollar and by 24.85% against the euro. Considering currency movement, the MSCI World Index has returned 0.83% in rand terms; the Bloomberg Barclays Global Aggregate Bond Index 27.30% (both these indices are negative in dollar terms).

Over five years all SA asset classes disappoint

Five years used to be reckoned as a long-term investment period and sufficient to yield strong inflation-beating returns. This is not the case in the current market slump. For the five years to 31 March 2020, the ALSI lost 0.13% annualised and listed property (the SAPY) cratered to -13.50% annualised. The ALBI and cash returned 5.18% and 7.22% respectively. In stark contrast, the MSCI World Index gave South African investors an 11.54% p.a. total return in rand terms; the Bloomberg Barclays Global Aggregate Bond Index returned 10.88% p.a. in rand.

International equities and bonds the 10-year top performers

Over the long run (10 years to 31 March 2020), international equities were the top performing main asset class from a South African investor’s perspective, with the MSCI World Index giving an annualised total return of 16.48% in rand terms. International bonds gave 12.01%. Locally, the ALSI returned 7.68% per year and listed property 2.82% per year. The ALBI and STeFI delivered 7.40% and 6.51% per year respectively over the 10 years to 31 March 2020. The rand weakened by 9.29%, on average, per year against the greenback and 7.03%, on average, per year against the euro over the past decade.

Source: Sanlam Investments | i-Net

Comments are closed.