The search for alpha in a low-growth world

Returns are getting harder to find thanks to the tightening of monetary policy in the US, and a slowdown in the synchronised global growth from the past few years. The fear is that this slowdown in global economic activity, the threat of trade wars and uncertainty about the consequences of further rate hikes in the United States could tip the world into a recession. So what should investors do in this environment of uncertainty?

Where do the opportunities lie?

Emerging markets

When investors initially jumped into emerging markets after the global financial crisis in 2008, they were looking for safety from failing banks and developed market turmoil at the time, along with attractive return opportunities. However, they experienced a bumpy ride.

Neal Smith, portfolio manager of the SIM Global Emerging Markets Fund at Denker Capital, explains, “We believe that across the emerging markets universe, there is a significant dislocation between the fundamentals of companies and the macro noise reflected in the daily media. Many emerging market companies are reporting robust growth in revenues and earnings, on the back of improving consumer sentiment in the different countries. But because of the poor macro outlook, share prices are being drive down and quality companies have become undervalued. This dislocation plays to our favour and gives us greater opportunities for selective stock picking and to invest in quality companies that were previously too expensive.”

Smith believes that, despite the recent pullbacks in emerging markets, there is value to be found and that emerging markets are set to continue their long-term trend of outperformance.

Here’s why.

Emerging markets outperform developed markets over the long term, despite short-term volatility

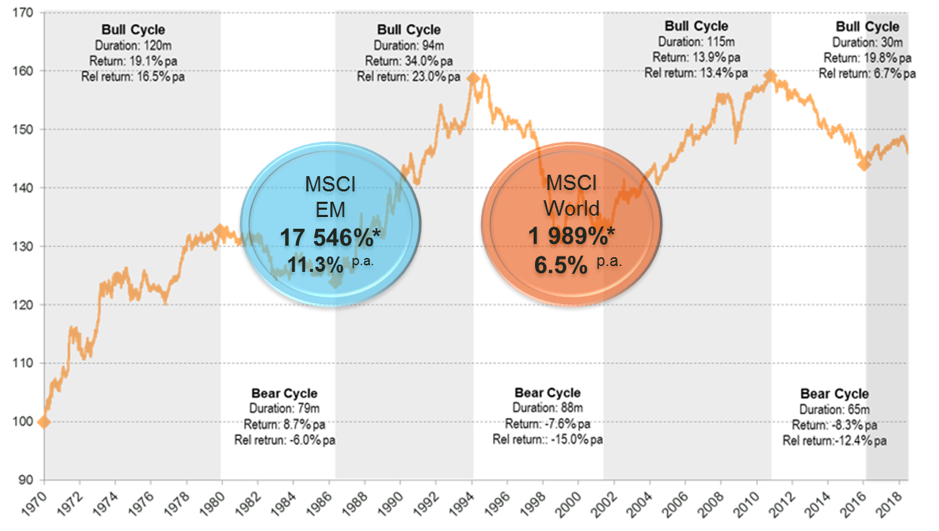

Emerging markets compared to developed markets: Relative equity performance index in log terms

* Cumulative USD total returns as at 30 June 2018

What we can see from this graph is that emerging markets outperform over the long term – and have done so consistently since 1970 – but this comes at a ‘price’: volatility in the short term. Moreover, growth in emerging market and developing economies (EMDEs) is projected to reach 4.7% in 2019 and 2020, up from 4.5 percent in 2018 (IMF, January 2018).

Historical annualised returns

While the MSCI EM index shows an absolute return of 11.3% per annum, the MSCI World index was almost half, at 6.5%. Compared to developed markets, emerging markets enjoyed a relative outperformance of 4.8%.

Smith stresses that long-term outperformance does not come in a straight line but rather with short-term volatility (which in itself creates buying opportunities), and these cycles can last a number of years. We are now into the next emerging market bull market, and despite the recent pullbacks valuations remain favourable with select opportunities for the clever bottom-up active manager.

Why we like emerging markets:

Powerful long-term growth drivers

- Emerging markets are attractively valued relative to developed markets, getting close to trough levels.

- Emerging market stock markets are significantly underrepresented in capital markets, relative to the size of their economies. Studies from the IMF show that when it comes to having the largest share of global GDP, emerging markets have now overtaken developed economies. It is interesting that the IMF expects emerging markets’ share of global GDP to increase at an ever faster pace going forward, growing at an average of 0.7% per year from now until 2019 to reach 54.5%. Leading emerging nations such as China, India and Mexico look set to contribute even further, following structural changes and recent reforms.

Emerging markets dominate global GDP

As countries move up the development curve, we expect their stock markets typically to grow, to better reflect the importance of their economies. This results in a rising ratio of market capitalization to GDP. In other words, we expect emerging market stocks to continue to continue their trend of long-term outperformance going forward (Denker Capital, 2018).

Amidst the doom and gloom regarding the state of emerging markets you read in the news today, we expect that the current volatility has created significant investment opportunities for patient investors.

Positive demographics

Unlike their developed market counterparts where populations are ageing, emerging market economies are expected to have greater future growth prospects, as populations are typically much younger and faster growing.

The challenges associated with ageing populations relate not only to the number of older people, but also the proportion of older to younger people. Ageing populations pose strong headwinds to economic growth; they place a heavy toll on healthcare systems; economic growth begins a steady downward decline due to an older and shrinking workforce; heavy demands are placed on the public pension system along with increased social responsibility, medical costs and increased taxes. Ultimately this negatively impacts the workforce, results in skills shortages, and constrains overall economic growth.

If emerging markets can support their demographic advantage with good economic policies, access to education and healthcare, they can unlock what is popularly known as their ‘demographic dividend’, which would be a very powerful driver of future growth.

Rapid urbanisation

Established cities tend to dominate global economic activity, more so than their populations would suggest. Large cities are home to 38% of the world’s population but generate as much as 72% of global GDP. This means that disposable incomes and wealth is significantly higher in cities; for example average urban incomes are roughly three times those of their rural counterparts in China and India.

It all boils down to economies of scale, says Smith of Denker Capital. For example, it is considerably cheaper to deliver electricity and basic municipal services to densely populated cities rather than sparsely populated rural areas, leading to greater cost savings. The same holds true for businesses, such as retailers operating in big cities. Here they enjoy the considerable advantage of greater foot traffic, leading to much higher sales and profit levels.

These income and cost advantages allow cities to attract more skilled workers and productive businesses, which in turn supports strong economic growth.

Emerging markets also have an abundance of natural resources and boast the vast majority of the world’s population. This, combined with positive demographics and rapid urbanisation, should support strong growth in emerging markets going forward.

Optimal diversification benefits

Historically, emerging markets have been excellent diversifiers. Although emerging markets generally remain somewhat more volatile than developed stock markets, institutional investors should be able to achieve greater diversification benefits and improved risk return profiles by adding emerging markets to their portfolios (up to around 50% for optimal diversification benefits).

* Cumulative USD total returns at 30 June 2018.

What about South Africa?

South Africa represents a mere 0.9% of global GDP and 1% of global market cap, making it a relatively small investment destination. Although the growth outlook for South Africa is improving, valuations in the country are still expensive compared to other emerging markets and developed markets. Investing offshore allows investors to diversify into a multitude of opportunities in countries, industries and companies that one cannot access locally.

Concluding thoughts

Long-term investors should reap the considerable long-term benefits of investing in emerging markets – if they can ignore the short-term volatility. The opportunity for those investors with an active management value bias, looking for higher returns, seems better than ever. Globally, investors are moving back into undervalued sectors as they seek out cheap valuations and alternative sources of alpha. Yet many investors have little or no direct exposure to this asset class. The perception is that of higher risk and, therefore, justifiably higher returns. “We believe the risks are arguably lower than many previously perceived them to be, and that current valuations remain favourable”, concludes Smith.

We expect that despite geopolitical turmoil, trade wars and the withdrawal of monetary stimulus, returns from emerging markets will outpace those of developed markets over time. The positive momentum of emerging markets, coupled with attractive valuations and fundamentals, gives long-term investors the opportunity to earn attractive risk-adjusted returns, while diversifying portfolios.

The focus should be on selective stocks that are undervalued and best positioned to benefit from the structural growth drivers that have long made emerging markets a compelling investment destination.

Comments are closed.