Factor investing: what it is and how to use it

Part 7/10: ESG and factor investing

Client level of adoption/allocation:

Over the past decade, investors have become increasingly concerned about social sustainability, and began to consider the natural environment, social impact and good governance (ESG) when investing.

Smart beta has seen a parallel increase in attention. While these two concepts may seem unrelated, we believe there is abundant opportunity for factor investing and responsible investing to collaborate within one investment process.

Figure 1: Selected factors/indicators of ESG investing

So, how can one integrate a responsible investment approach with the power of factor investing? Two approaches are typically used here.

The first framework involves treating ESG as a systematic factor itself. Company data can be assigned numerical ESG scores, which can then be easily transformed into exposures (eg: z-scores) that form the basis of a factor model. This approach has to be considered cautiously, as:

1) ESG scores historically have shown to be correlated with traditional factors such as Quality and Low Volatility.

2) On a more philosophical note, ESG by definition is more an expression of an investment rule, rather than capturing a well-understood driver of return that delivers a compensating premium above the market.

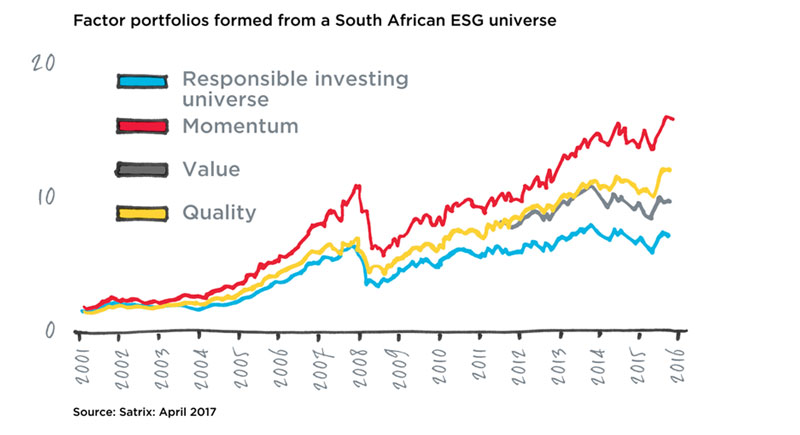

The second approach involves a framework where, based on ESG scores, an ESG universe is filtered and screened from a broad market universe and then forms the basis on which traditional factors are overlaid. We illustrate this approach in Figure 1 below, where we’ve taken a South African Responsible investing universe (based on an ESG exclusion list) and constructed Momentum, Value and Quality portfolios from this universe since 2001 on a quarterly basis. When using this approach, it is important to understand the interaction between each factor and the selected ESG universe.

Figure 2: Factor portfolios formed from a South African ESG universe

Globally, institutional investors have already started integrating responsible investing into their mainstream investment processes, formalising how they responsibly engage and manage their investments. In our view, adding a dimension of factor investing to this process will reflect positively to an ESG investment proposition, ultimately enhancing risk-adjusted returns over time for both investors and society.

For more information on this topic or further details on our analysis, please feel free to contact us directly.

Comments are closed.