Longevity and sequence risk: stop these from ruining your retirement

By Paul Wilson: CIO of Sanlam Investments Multi-Manager & Lizelle Steyn: Investor communication specialist

According to the most recent Sanlam Benchmark Symposium survey, 51% of pensioners can’t make ends meet. About a third don’t have enough funds to cover their medical expenses. Also, about a third entered retirement in debt, and more than half still have to support adult dependants. As a result of these financial pressures, 61% simply can’t afford to save for a ‘rainy day’ fund, leaving them unprepared for unexpected expenses. These statistics show that for many South Africans, retirement is a constant battle for survival.

Longevity is only a blessing when it’s well planned for

Retirees have a choice between purchasing a living annuity or guaranteed annuity upon retirement. In this article we assume the choice made by the retiree is to take control of their own retirement capital by purchasing a living annuity. When doing so it’s pivotal that the capital lasts at least as long as their remaining lifespan. How long that time frame would need to be is the million dollar question and this is what is known as longevity risk. Most people look towards their parents’ and grandparents’ lifespan when estimating how long their money needs to last. But unprecedented advances in the medical sciences over the past decades and improved remedial care have resulted in significantly improved life expectancy. According to Sanlam’s actuarial team, a male born in 1967 can expect to live to age 91. A female will live even longer.

In the light of increased longevity, how then do we make retirement savings last long enough?

Run-of-the-mill returns don’t keep up with drawdown rates

One approach is to manage your living annuity in such a way that you only draw the income portion and keep the capital intact. It’s important to bear in mind, though, that the remaining capital base after drawdowns would need to grow by inflation each year, for your income to sustain your lifestyle in the face of inflation eroding your purchasing power over the years. If, according to Asisa, the average living annuitant draws 6.5% of their investment value every year, this means that their investment returns would need to average a rate equal to inflation plus 6.5% per year after fees. Realistically, your standard SA balanced fund would not be up to this challenge.

Sequence risk – the risk of timing your retirement badly

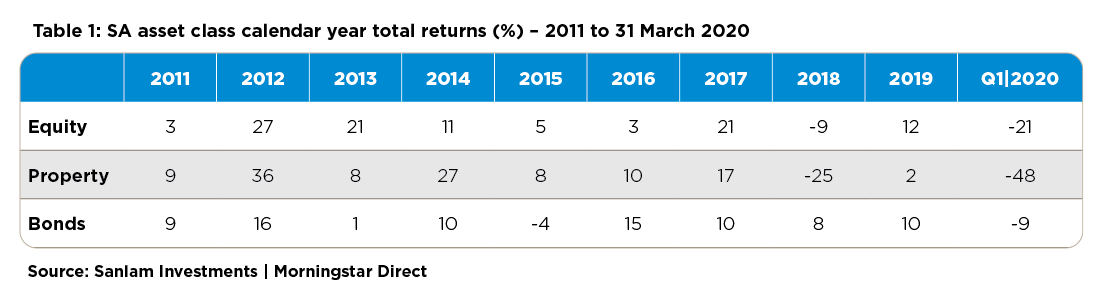

Above we refer to investment returns needing to average 6.5% after adjusting for inflation. In reality, returns can range from exuberantly positive to dismally negative from one year to another, as the table below shows.

In the decades leading up to your retirement you can ‘absorb’ the blow of years of negative or stagnant return years and wait for years with good returns to make up investment losses. But in retirement, every year of poor investment performance is felt immediately. The year in which you start your retirement journey can make a significant difference to your retirement income. Two retirees earning the same average return can see their capital behave very differently when they enter retirement at different phases of the market cycle. This phenomenon is known as sequence risk. We illustrate with an example below.

Sequence risk: case study

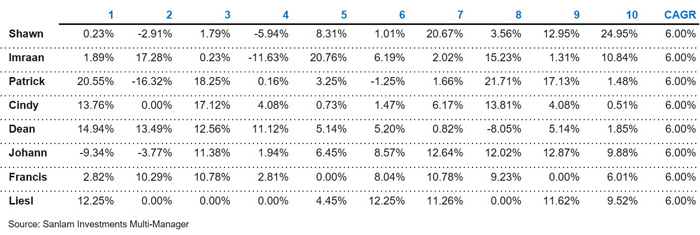

Table 2: Hypothetical annual returns by 8 investors all earning 6% on average over 10 years

Let’s assume each of our eight investors has R1 000 of retirement capital and each withdraws 5% per year, growing by inflation. How much would their remaining capital be worth after 10 years taking into account the different return experiences tabled above?

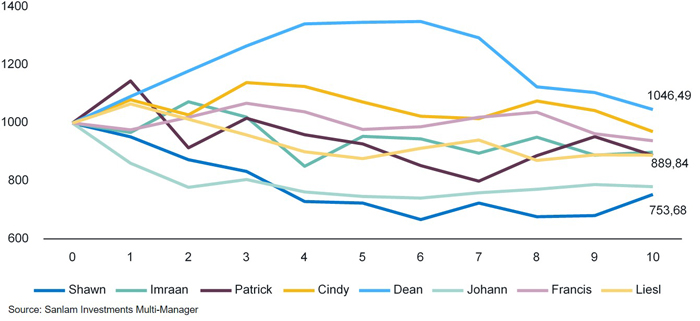

Chart 1: The impact of a different sequence of returns on annuitants’ capital

Dean, who had a stellar first few years in retirement but negative and sub-inflation returns later in the 10-year period, ended up with more than his initial capital amount after 10 years. In comparison, Shawn, who had pedestrian and slightly negative returns in his early retirement and excellent returns later in the 10-year period, saw a substantial chunk of his capital being eroded over 10 years. In fact, despite both averaging 6% per year, Shawn’s sequence of returns left him with only three-quarters of Dean’s remaining capital amount, and hence only three-quarters of Dean’s retirement income after 10 years. The negative impact of sequence risk can be substantial.

Investors retiring at the start of 2015, 2016 and 2018 would have had a real-world experience of Shawn’s scenario, meaning they would have needed much higher than average future returns after those years to take their capital balance back to the initial amount and sustain their required retirement income level.

But there’s hope – tools to combat longevity and sequence risk

As mentioned, the standard balanced fund – in which most living annuitants are invested – does not have what it takes to deliver large enough after-inflation returns on a consistent year-after-year basis for the drawdown levels that South African retirees need. Fortunately, there are portfolio construction tools available that – to an extent – can mitigate against longevity and sequence risk in retirement by trying to achieve an asymmetrical distribution of returns using the following strategies, 1) absolute return funds, 2) smooth bonus funds and 3) alternative assets.

Absolute return funds ‘soften’ negative years

The first step to narrow the wide range of possible returns in an investment-linked living annuity is to choose a fund with an absolute return focus. The asymmetric nature of these funds mean they capture less of market downturns than conventional balanced funds, while aiming to still capture a decent amount of bull market runs. When an absolute return funds does what it says on the label, it reduces the sequence risk of a retiree’s portfolio by cutting off the negative returns within the return distribution.

Smooth bonus funds create more income stability

A smooth bonus fund is another tool that can reduce volatility and sequence risk in a living annuity portfolio. By holding back excess returns in good years, and releasing them back to investors in years when markets perform poorly, the investor has a more stable return experience in the form of smooth bonus declarations on a year-by-year basis. This is an excellent tool in trying to achieve asymmetry in returns.

Alternative assets are there to boost returns

Even when smoothed, though, it’s a challenge to achieve the after-inflation return that retirees require to enable them to use as little as possible of their capital. A living annuity portfolio therefore needs a third step – return boosters. Fortunately, there is an arsenal of alternative assets that can do this job: hedge funds, private equity, mezzanine debt, unlisted credit and unlisted property, to name a few. These are expected to generate higher returns as a result of harvesting of the illiquidity premium. Alternative strategies are used extensively in the institutional space, but due to accessibility issues have not yet been made available to retail investors as an option to utilize. This is something we are aiming to change as these investments can definitely form a crucial part of a solution in order to assist investors in reducing sequencing and longevity risk.

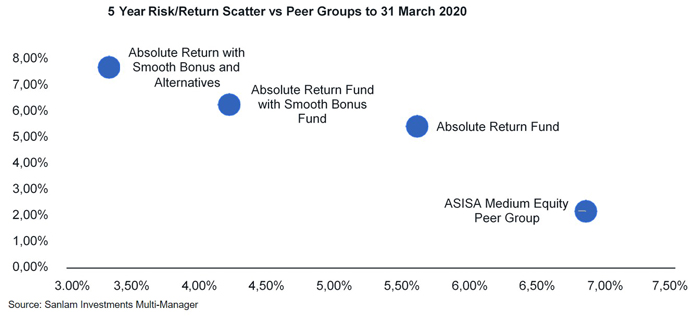

The chart below shows how taking all three steps – starting with an absolute return fund, augmenting it with a smooth bonus fund, and then adding alternatives – can substantially reduce the risk in a portfolio and provide higher returns.

Chart 2: How using all three tools improves the living annuitant’s risk-return experience

To conclude, new thinking is required to solve the investment-linked living annuity problem for retirees. It’s time to use the full range of appropriate portfolio construction tools available to reduce investors’ longevity and sequence risk, and provide the golden retirement solution, a sufficient and stable retirement income for life.

Comments are closed.