Investors’ Legacy Range

There’s something to be said for leaving a legacy. Building something that will be used for generations to come. Helping create lasting, sustainable impact in the economy and its communities.

“HE WHO PLANTS TREES

KNOWING THAT HE MAY NEVER

SIT IN THEIR SHADE, HAS AT

LEAST STARTED TO UNDERSTAND

THE MEANING OF LIFE.”

Rabindranath Tagore

“IF YOU WANT TO GO FAST,

GO ALONE.

IF YOU WANT TO GO FAR

GO TOGETHER.”

African proverb

Imagine a future built on sustainability.

What would our world look like? What impact could we have on impoverished communities?

One thing we do know is that when we invest in a future we need, the possibilities are limitless.

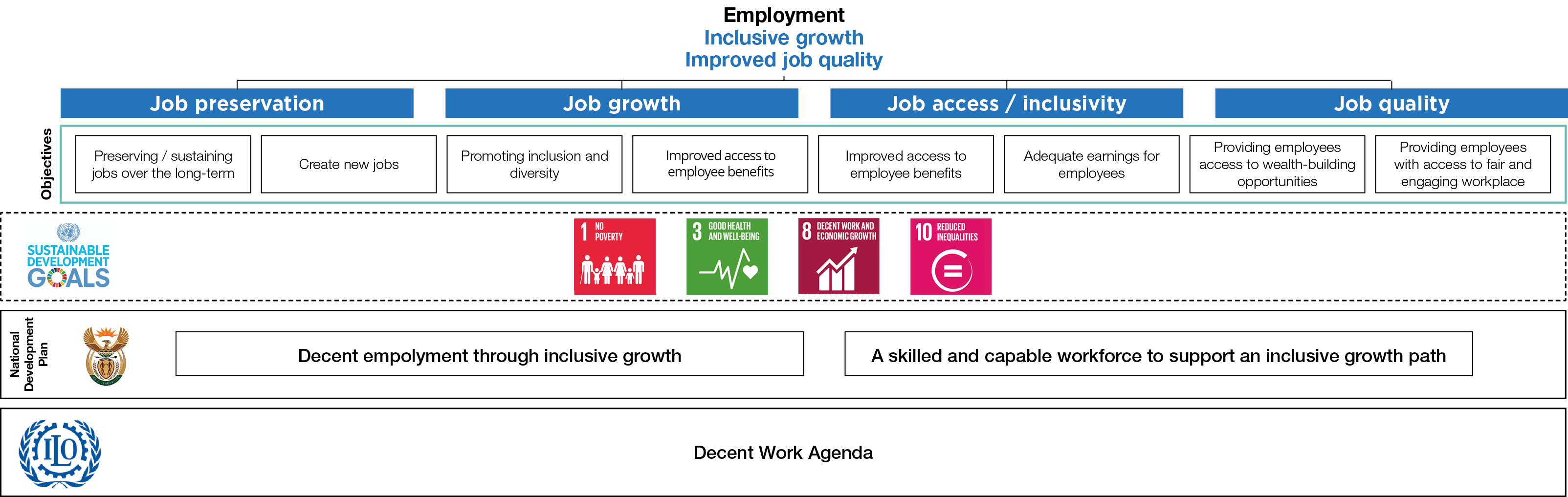

You too can leave a legacy by investing in impact funds which are designed to deliver both a positive social and economic impact, while also generating favourable returns. These funds in our Investors’ Legacy range are focused uniquely on job preservation and creation.

SME Debt

We provide debt finance to good quality SMEs which make a significant contribution to economic growth. Investors benefit from great returns while creating jobs and meaningful impact in other areas such as education and energy access.

Sustainable Infrastructure

We invest in tangible economic infrastructure assets in sectors such as renewable energy, transportation, communication, water and waste projects, AND offer investors compelling returns.

Investors’ Legacy

Mid-Market Private Equity Fund

We invest in high-quality unlisted businesses with strong management and significant growth potential. We prioritize job quality, preservation and inclusive growth, while seeking equity returns across a diverse investment portfolio.

WHY INVEST

-

These funds are designed to produce a positive social and economic impact, while generating powerful risk- adjusted returns.

-

Private markets offer diversification from (and low correlation with) traditional asset classes.

-

Unique investment opportunities – investors have access to opportunities that listed markets don’t offer, particularly exposure to under-represented sectors on the JSE and companies with high-growth prospects but which are too small to be listed.

-

Long-term growth potential – over a long investment period, investment returns in private markets typically outperform public markets on both a risk-adjusted and absolute basis.

-

Stability – factors which impact returns in public equity markets (such as volatility, investor sentiment and the tendency to focus on quarterly results) have less effect on the valuations of private market assets.

Investors’ Legacy Range

People matter most.

OUR IMPACT: ESG MANAGEMENT

Investors’ Legacy Range

People matter most.

OUR PEOPLE

CEO of Sanlam Alternative Investments for Sanlam Investments

Steven Rosenberg

INVESTORS’ LEGACY

SME DEBT STRATEGY

Erica Nell

Vukile Themba-Mketo

INVESTORS’ LEGACY

SUSTAINABLE INFRASTRUCTURE FUND

Pawan Singh

INVESTORS’ LEGACY

PRIVATE EQUITY STRATEGY

John Seymour

Paul Moeketsi

Investors’ Legacy Range

People matter most.

MEDIA

Sanlam Investments partnership with Absolute Pets' is a shining example of how businesses can make a meaningful impact.

Read moreVukile Themba-Mketo, portfolio manager for the SA SME Debt Fund, talks about the role of SMEs in our economy.

Watch videoInvestors’ Legacy Range

People matter most.

The Investors Legacy Range is our desire to mobilise capital from like-minded investors, support business growth, create jobs and help investors leave a legacy for tomorrow. To make a difference.

To create certainty in a world of uncertainty. To give people hope.