Demystifying derivatives: taking risk off the table

Derivatives have been given a bad rap after certain funds, like the ill-fated Long Term Capital Management, used them to leverage their market exposure to such excessive levels that they blew up and put the entire global financial system at risk.

Investment banks also had a reputation for putting together complex, opaque derivative structures that they sold to clients and ended up being costly and ill-advised. Derivatives are also viewed as speculative investment vehicles and, as such, are seen as risky instruments.

However, there have been many more instances in which derivatives have been used to successfully reduce risk to the advantage of the investors who would otherwise have experienced the full force of market declines. In this case, derivatives are used to hedge against a possible undesirable future event.

For instance, an investment manager could be concerned that markets may fall off substantially in the upcoming months and knows that the investors in his fund could not tolerate such a decline. The manager would then invest in a hedging structure that limits the downside risk of the fund – a decision that protects the value of the assets under his fiduciary duty from being eroded. But these are the stories that rarely make the headlines and thus sentiment regarding the use of derivatives remains cautious at best and fearful at worst.

Current market conditions are exceptionally volatile and the future of the global economy is wrapped up in the escalation of trade tensions. It is at times like these that derivatives have an important contribution to make to investing because, instead of being used to gear up a fund, they can be used as a form insurance to alleviate the impact of market downturns on a fund.

With this context in mind, it is evident that it’s not the derivatives that are the problem, but how they are used. In the right hands, they are a valuable addition to an investor’s toolkit – particularly when market conditions are precarious and unpredictable.

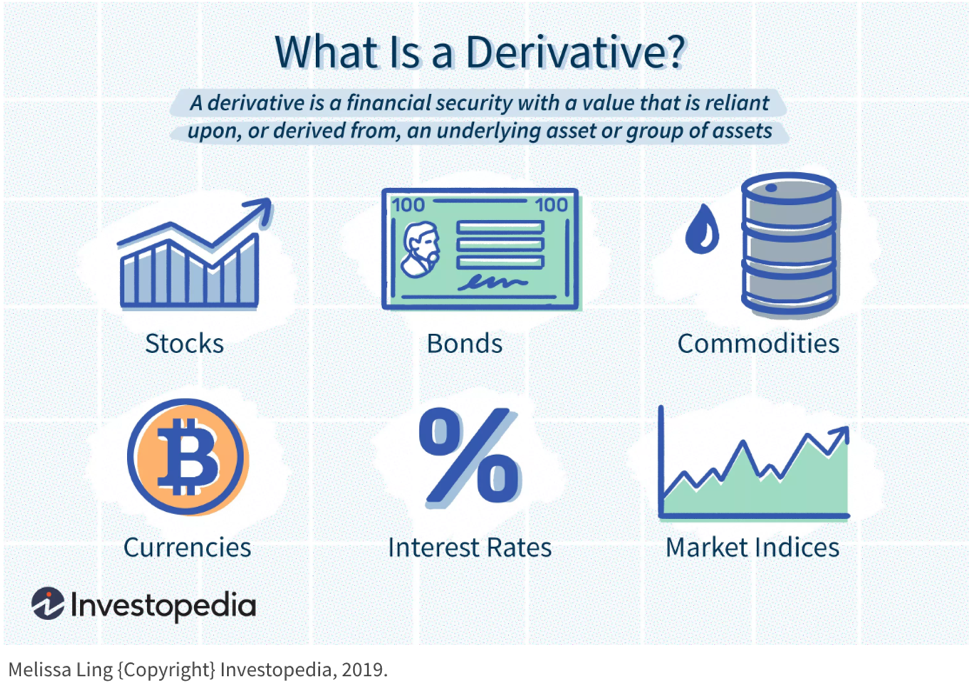

What is a derivative?

A derivative is an investment instrument whose value is derived from the underlying asset. There are derivatives on equities, stock market indices, bonds, commodities, precious metals and currencies to name but a few.

The most-used derivative instruments include options, swaps, futures and forward contracts. These either effectively give the investor the option to buy or sell an asset in the future at a set price, and can be combined in any manner of structures to suit the needs of the investment manager.

How can fund managers use derivatives?

At Sanlam Investments, we believe that there are benefits to using derivatives as a portfolio management tool. There are three broad ways in which our fund managers use derivatives to add value to the portfolios in which they invest.

The first is as a straightforward insurance policy, with derivatives performing as a hedge against an undesirable market event. Hedging can be instituted in many shapes and forms and is most commonly used to protect the portions of the portfolio from sharp selloffs.

Balanced funds portfolio manager Ralph Thomas uses derivatives to remove a portion of the risk that he doesn’t believe is appropriate for the investors in the funds he manages.

He introduces tactical derivative overlays to the portfolio to enhance or protect the fund from potentially adverse future market or stock-specific movements.

Derivatives also enable fund managers to amplify their views on specific asset classes or a share. Thomas gives the example of Naspers, which dominates the FTSE JSE SWIX Index at 26% of the Index. Although Naspers may have significant upside potential, it is still a significant concentration risk within the portfolio because if something unanticipated were to occur the entire portfolio would be affected. However, it would be risky to avoid the stock too given its upside potential.

To protect the investors in the fund against a negative event, the fund managers put in place a derivative structure that hedges (insures against) the downside risk, limiting it to 5%, with a maximum upside in the share of 23%. That means that if the Naspers share were to slump, the portfolio would only participate in the first 5% decline and investors would be protected thereafter. The nature of this particular derivative structure is that it does come at the cost of limiting the upside to 23% but this is small price to pay for avoiding significant losses were Naspers share prices to come off sharply.

In this instance, the fund manager has made the calculated decision to forfeit full participation in the upside because of the concerns about the prospect of a downturn. Derivatives create a degree of certainty in increasingly uncertain markets, enabling the fund to take protected positions where a more traditional fund management approach would not.

Enhancing returns with portable alpha

Another more sophisticated use of derivatives is portable alpha which is used to enhance returns delivered by passive funds. Guy Fletcher, Head of Research and Client Solutions, Sanlam Investments, explains that instead of simply replicating a given benchmark as closely as possible, derivatives give fund managers an added dimension to enhance returns, without using leverage. This is with the addition of portable alpha.

But what is portable alpha? Portable alpha involves seeking the market return (commonly referred to as beta) from one asset class and excess return (commonly referred to as alpha) from a different one, and then merging the two. And the best form of portable alpha is the one that is completely uncorrelated to the beta the fund manager wants to enhance.

The concept of portable alpha has been around for decades, and is a highly effective strategy in delivering excess returns over benchmarks. It is particularly appropriate in higher yielding environments (such as South Africa) where money market instruments deliver vastly improved returns over cash on deposits at commensurately lower risk.

As you can see, derivatives can be used in a myriad of different ways and, if used with good intentions, skill and experience, they could add great value to portfolios by either reducing risk or enhancing returns. With that in mind, it would be short-sighted to dismiss their usefulness out of hand based on the few high profile disasters that occurred when these instruments were used by investors with only their own self-interest in mind.

Comments are closed.