Equities – Not For Everybody

By Carl Roothman, Head of Retail Business

We are well aware that an adviser’s job is never done. No matter how thoroughly you explained to your clients what to expect from the equity market, when markets suddenly fall and alarmed investors start to call, the toughest part of your client journey starts: assuring investors that choppy waters too can lead to the right destination.

Colin Shaw, author of ‘Building great customer experiences’ was one of the first client experience designers to draw attention to the fact that the client experience starts with an expectation and ends with an emotion. The better businesses prepare clients for the potential negative experiences that may lie ahead, the better are the chances of a positive emotional outcome.

We’ve therefore compiled some data to help you manage your clients’ expectations around equities (shares).

Equities are not for those who…

• Invest for the short term

Investors driven by greed or sometimes desperation, needing to make up a shortfall in terms of a future liability, such as their children’s university education, often turn to shares to boost their wealth fast. But equities are not there for those wanting to make a quick buck.

In September 2008, world financial markets came under severe pressure and the ALSI reacted by losing around a third of its value up to year-end. Only by mid-November 2009, the ALSI had recovered from its lows. Investors in the equity market for the year from September 2008 to September 2009 would therefore not even have regained their capital, let alone keeping up with inflation.

Equities are therefore absolutely not for clients wanting to invest for periods shorter than three years. The risk of losing money in real terms is simply too high.

• Try and time the market

Seasoned investor Peter Lynch said, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” Because of the asset class’s proven long-term inflation-beating characteristic, investors with very long-term horizons (10 years or more) should remain as fully invested in equities as possible at all times. Those who want to try and time the market, switching out when they think the market is close to its peak and switch back in again when it’s close to the bottom, can try the casino instead. They may have better luck there.

Timing the market is just not worth the risk.

- Panic easily

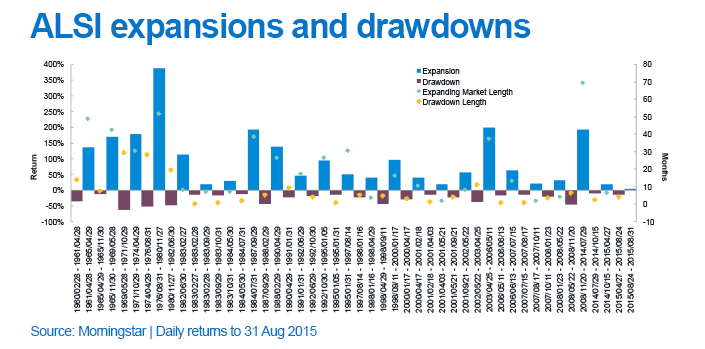

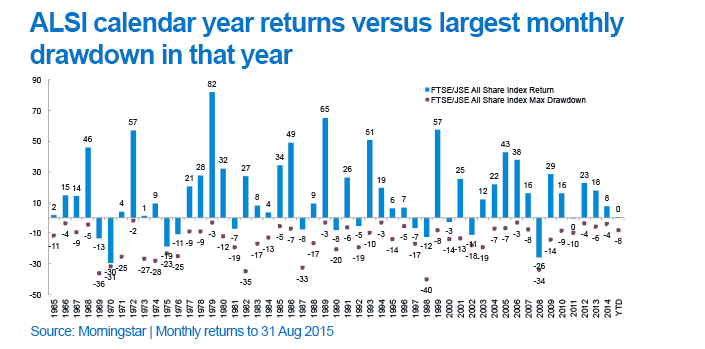

Short-term volatility of the equity market is perfectly normal. Every time the market corrects (fall by more than 10%) your clients may want to get out of the market ASAP. But, if they look at the two graphs below, they’ll see that the ALSI has risen far more than it has fallen, and the long-term trend of the market has always been upward.

It’s, however, extremely difficult to predict when, and by how much, markets will rise and fall. If your clients sell in a panic after the first signs of a market correction, they may miss out on good performance days, resulting in an overall drop in their return. Where you don’t want to be on the good market days is out of the market. And there’s no way you can predict when those days will be.

Besides, historical ALSI data indicates that it is highly likely long-term equity investors will reap positive real returns when they invest for 10 years or longer and highly unlikely that they will lose any capital when they invest for five years or longer.

- ‘Watch the pot’

With the advent of real-time investment reporting, your clients can now view their portfolio values online on a daily basis. While the rise in transparency is positive, the flipside is that investors who tend to ‘watch the pot boil’ are now more likely to compare their funds’ performance with that of their peers, often leading to buyers’ remorse and switching to the funds that outperformed recently.

According to a study by Dalbar, over the past 30 years the average investor in an equity unit trust in the US earned an average of 3.8% a year —a third of the Standard & Poor’s 500’s average 11.1%! This is mainly due to switching in and out of funds at the wrong time, chasing outperformance – an exercise which is more often than not counterproductive.

Advice for everybody

To summarise, when investing for growth, equities are instrumental. As financial ‘insiders’ we need to get the following three things right, though:

- Make sure our clients have the right equity allocation % for the right timeframe

- Manage our clients’ expectations before they commit to the investment

- Help our clients to stay the course – let the market do the rest.

Comments are closed.